The Netherlands - Political turmoil amid economic resilience

Q1 GDP revisions suggest a more positive start to 2025, lifting our annual forecast from 1.2% to 1.6%. Tariffs will weigh on activity in the near term, directly and indirectly via main trading partners. The Dutch government fell, adding domestic policy uncertainty amid elevated international uncertainty. With elections on 29 October, 2026 will be well underway before a new government is installed.

June proved to be a (geo)political hot month for the Netherlands. The month kicked off with the collapse of the Schoof I cabinet, with previous election winner the far-right PVV quitting the coalition over migration. As written while the short term growth implications are limited it likely leads to further delays in addressing the several supply constraints that affect the economy, of which the most prominent ones are the nitrogen crisis, housing and the electricity grid. Furthermore it adds domestic policy uncertainty to an already internationally uncertain environment. This situation is expected to linger for quite some time. With elections on 29 October, and coalition negotiations typically lasting months, 2026 is likely to be well underway before a new government is installed. It also meant that the government had a caretaker status while hosting the first ever NATO-summit in The Hague. But given a broad majority in favour of higher defence spending in parliament, the caretaker government could still sign off on the new 5% NATO target.

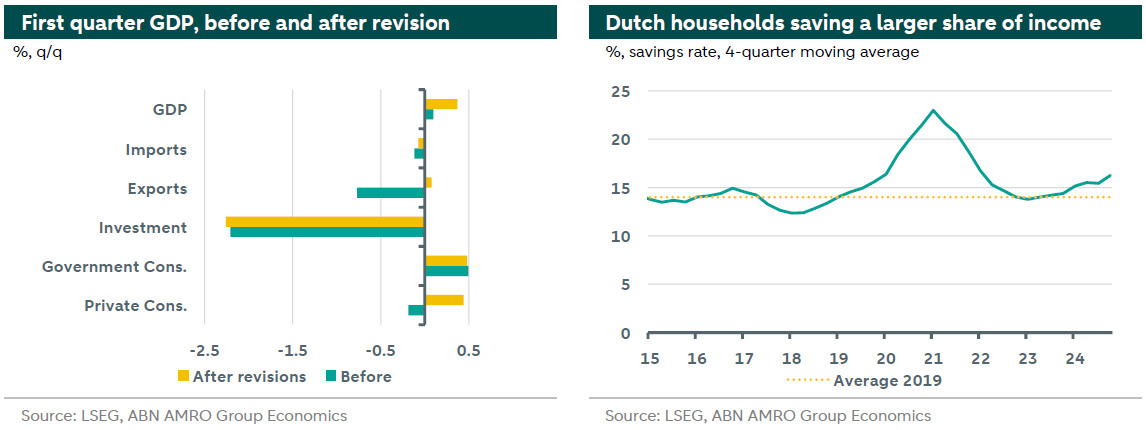

Against the backdrop of political turmoil and geopolitics the Dutch economy is showing resilience in the first half of 2025. First quarter GDP was revised upward considerably from 0.1% q/q to 0.4% q/q, coming much closer to our initial forecast of 0.5% q/q and painting a much better start to the year than shown by the first calculation. Volatility in export data was to be expected due to frontloading of trade in anticipation of US tariffs but there was also a large adjustment in private consumption. The upgrade to Q1 GDP mechanically lifts our 2025 annual growth forecast from 1.2% to 1.6%. For the remainder of the year we expect positive quarterly growth, with a slowdown in the middle of the year due to US tariffs affecting exports directly as well as indirectly via other main trading partners. The Dutch economy is resilient going into this tariff shock. Indeed, employment is rising further, wage growth continues to outpace inflation and households have – in general – healthy balance sheets. Interestingly, after rising for the past few quarters from pandemic lows, bankruptcies seem to be stabilizing at more normal levels for now, whereas we previously expected a further rise. Together with an expansionary fiscal stance by the government, these developments bode well for domestic demand being the driver of growth going forward. Still uncertainty is keeping a lid on this as there seems to be some hesitation among households to spend, as is visible in low consumer confidence and a still rising savings rate of Dutch households.

Inflation (CPI) declined markedly to 3.3% in May, down from 4.1% in April – still high compared to the eurozone, where inflation is around 2%, but moving in the right direction. Services inflation eased, particularly in tourism related categories, in part due to a base effect from the timing of the May holiday. Over the coming months we expect inflation to ease further as lower wage growth will soften services inflation further and higher VAT-rates on tobacco – constituting a strong upward effect since June 2024 – dropping from the inflation figures. We expect inflation this year to average 3.4% and to decrease to 2.6% in 2026. With that, Dutch inflation continues to outpace eurozone inflation, but the gap is expected to narrow going forward.