China - Focus in US-China talks shifts from tariffs to chokepoints

Chinese economy shows resilience after US-China truce, but supply side still stronger than demand side. China-US relations: Damage control in place, focus shifts from overall tariffs to chokepoints. Support is being delayed given resilience, but we still expect more to come to support demand.

Chinese economy is showing resilience during period of heightened trade tensions

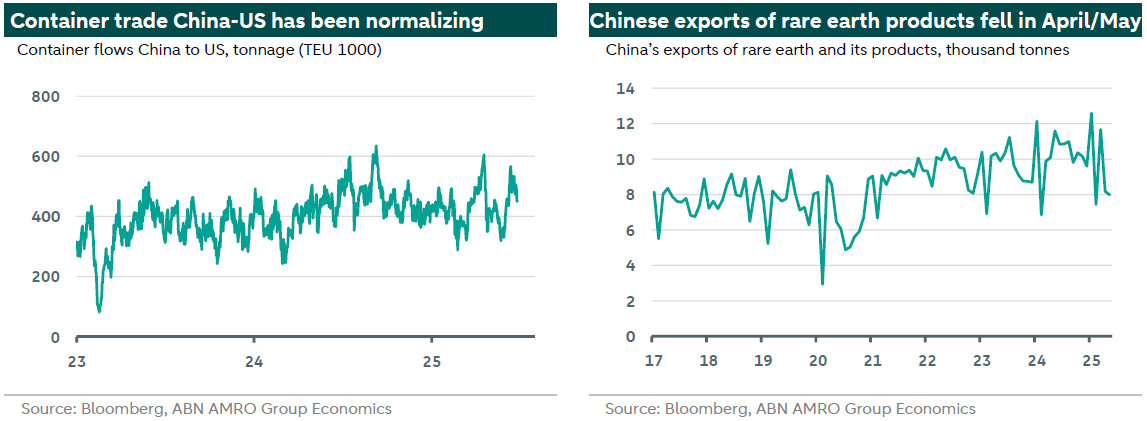

May macro data and June PMIs confirm the resilience of the economy, after the Geneva truce with the US reached in mid-May softened the key drag. Export growth slowed in May, but still held up pretty well – in line with our view that the direct export shock to the US is being mitigated by trade circumvention and export diversification (next to big tariff exemptions). China-US container flows have come down recently, but that seems to reflect a normalization after a catch-up in May following the collapse in April. Industrial production slowed a bit, but remained solid (5.8% y/y). The jobless rate dropped to a six-month low of 5.0%. Retail sales were the positive surprise in the May data (6.4% y/y), but that seems to be driven by an extension of consumer subsidies and seasonal effects rather than pointing to a clear demand revival, with other data being less favourable. Import growth turned more negative (-3.4% y/y), deflationary pressures did not soften (CPI) or even intensified (PPI), and property market data weakened. All in all, the supply side remains stronger than the demand side and the negative feedback loop from real estate has not been broken yet.

China-US: Damage control in place, focus shifts from overall tariffs to chokepoints

The Geneva truce agreed mid-May lessened the key headwind for the Chinese economy. The combined total tariff levels are now close to what we had factored in before the start of trade war 2.0. That said, tensions have flared up since Geneva, as the focus shifted from tariffs to ‘chokepoints’ – i.e. the supply of crucial inputs for which both countries are reliant on each other. During the trade war escalation in April, China tightened export controls of rare earth and related products, which threatened to impact industries reliant on these inputs in the US, but also in the EU (which still is negotiating with China on products like electric vehicles, medical devices, etc.). Following a phone call between Trump and Xi, and renewed talks in London, the US and China seem to have managed to prevent trade relations escalating out of control again. Recently, a trade framework on top of the Geneva truce was confirmed by both countries, with agreements made over Chinese rare earth exports in exchange for an easing of US (tech) and other restrictions. All in all, we think the US-China relationship will remain rocky, but financial market reactions, corporate lobbying and (chokepoint) dependencies have reduced the probability of worst-case scenarios for the time being.

Support is being delayed given resilience, but we still expect more to come

With exports holding up well, GDP growth in 25H1 is set to exceed the 5% target. And adverse tariff scenarios are less likely now. Against this background, Beijing does not seem to be in a hurry to add additional stimulus. Still, we expect more fiscal and monetary stimulus to come. First, because Beijing’s key policy priority for 2025 (boosting domestic demand) has not yet been reached. Second, we expect y/y GDP growth to fall below target in 2H-25 (partly reflecting base effects). Our growth forecast for the whole of 2025 is 4.7%, a bit above consensus at the moment. The property market is not out of the woods yet, consumer confidence remains weak, and deflationary pressures continue. Moreover, some fiscal measures have been frontloaded and their effects will fade if no new measures are being taken.