SustainaWeekly - Are Transition Critical Materials the new oil?

In this edition of the SustainaWeekly, we start by focusing on Transition Critical Materials (TCMs). Strong growth of demand for these materials may create supply-demand bottlenecks as the path to net zero accelerates. We assess the macroeconomic consequences of the evolving demand for these materials and the risks to the economy of potential supply-demand bottlenecks. We go to analyse the EU Commission’s inclusion of new activities under the Taxonomy. These include for example aviation and shipping as transitional activities. Finally, we look at the consequences of the possible inclusion of the maritime sector in the EU ETS next year.

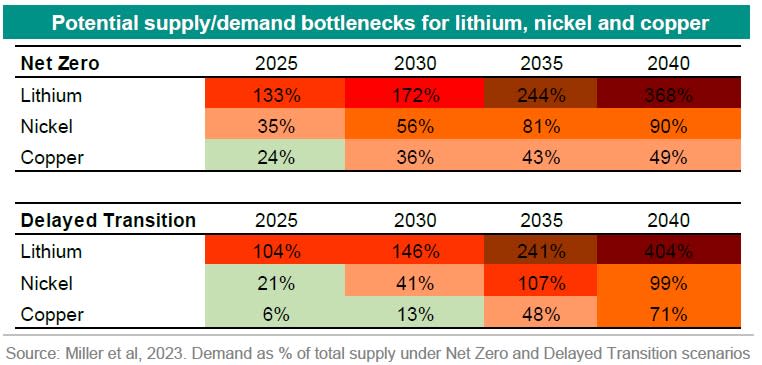

Economist: Demand for Transition Critical Materials would need to increase sharply to achieve net zero. Lithium and nickel demand would outstrip supply under Net Zero and Delayed Transition scenarios. Though the passthrough to consumer prices will be smaller than an equivalent sized shock to fossil fuel prices. Bottlenecks may cause policy challenges and operational delays, particularly for low carbon tech production.

Strategist: The EC released a draft delegated act proposing the inclusion of new activities under the Taxonomy. These include for example aviation and shipping. Research shows that a significant share of existing aircraft complies with the proposed EU Taxonomy criteria, which brings into question whether the inclusion of these activities will in fact incentivise financing towards the development of sustainable aircrafts and jet fuel.

Sectors: The maritime sector is responsible for around 2-3% of greenhouse gas emissions. The sector will likely be included in the EU ETS in 2024. The inclusion of shipping will follow a phased approach in terms of emissions, but also in terms of what ships are included. For the maritime sector, all GHG emissions will be included from 2027 onwards. The EU has put the heat on the maritime sector to bring down emissions at a faster pace.

ESG in figures: In a regular section of our weekly, we present a chart book on some of the key indicators for ESG financing and the energy transition.

Are Transition Critical Materials the new oil?

Demand for Transition Critical Materials would need to increase sharply to achieve net zero

Bottlenecks could arise from supply concentration and geopolitical risks

Lithium and nickel demand would outstrip supply under Net Zero and Delayed Transition scenarios

The passthrough to consumer prices will be smaller than an equivalent sized shock to fossil fuel prices

Bottlenecks may cause policy challenges and operational delays, particularly for low carbon tech production

Introduction

The path to net zero is paved with images of low carbon technologies such as wind turbines, solar panels and battery storage facilities. Embedded in these technologies are a wide variety of materials such as lithium, cobalt, and nickel that are critical inputs in the manufacturing process and many of these are already difficult to source. Strong growth of demand for these materials may create supply-demand bottlenecks as the path to net zero accelerates. In this note we focus on the macroeconomic consequences of evolving demand for these Transition Critical Materials (TCMs) and the risks to the economy of potential supply-demand bottlenecks.

Demand for Transition Critical Materials may increase sevenfold until 2040 in transition scenarios

Starting with demand, we know that demand for key minerals is on the rise, but a reliable long term forecast is tricky. The most important source of that uncertainty is the level of climate ambition and the speed with which that ambition is to be realised, both of which are ex ante unknown. But it is equally important to highlight other known factors that will influence demand, including shifting consumer preferences and technological innovation, especially where the priority of that innovation is to replace difficult-to-source critical minerals. And where technology already exists, for example in the substitutability of aluminium and copper for the grid, demand will additionally depend on the relative price of each metal, which again is hard to forecast with certainty.

look into the emergence of potential TCM bottlenecks in two well-known climate scenarios from the Network for Greening of the Financial Sector (NGFS): the Net Zero orderly and timely transition scenario and the Delayed Transition scenario. The Net Zero orderly scenario is a high ambition scenario in which governments and the private sector acts immediately and with the level of intensity that is sufficient to eliminate emissions by 2050. The ambition levels are similar in the Delayed Scenario except that policy only starts to bite in 2030. The paper finds that under Net Zero, demand for critical materials doubles from 2025 to 2035, and increases 7 times between 2021 and 2040. Under the ‘Delayed Transition’ scenario, the absolute annual increases are necessarily substantially larger after 2035. This faster increase in demand over the observed timeframe could have a more disruptive impact on the market. Most “critical” in terms of demand side pressures are found to be cobalt, copper, graphite, lithium, manganese, molybdenum, nickel, rare earth elements, and vanadium.

Bottlenecks could arise from supply concentration and geopolitical risks

Set against that uncertain demand outlook are a number of possible bottlenecks that relate to supply. A stable supply chain would ideally have a diverse geographical spread of material reserves supported by multiple facilities for extraction and processing. This is not the case for a number of critical minerals, including cobalt and rare earth elements where, for example, the Democratic Republic of Congo and China control 70% and 60% of global production respectively and China controls 90% of refining capacity. China also controls of 50-70% of lithium and nickel refining capacity (). Worries about geographical and processing concentration are further amplified by very legitimate concerns about human rights/child labour and other ESG issues in the mining and processing of these minerals. For example, some 50% of lithium and copper production is concentrated in areas that are considered water-scarce. That’s not all. Other possible hurdles to supply include emerging protectionist policies such as those embodied in the Inflation Reduction Act and potential tit-for-tat policy responses elsewhere.

Lithium and nickel demand to outstrip supply under Net Zero and Delayed Transition

Abstracting from these concentration risks and geopolitical tensions and according to the paper, under both NGFS scenarios, the production and supply of TCMs would have to significantly increase to meet the demand created by the projected capacity additions for low-carbon technologies. When combining demand pressures with projected supply developments, a picture of where possible demand-supply pressures might arise materialises (in this part the paper focuses on lithium, copper and nickel, for their relevance for the transition and availability of data). The rate of increase of demand as a proportion of supply is taken as an indication of supply-demand mismatches that could have implications for financial and price stability.

Results show that demand for lithium (especially for batteries in electric vehicles and storage generally) starts to outstrip supply in both the Early and the Delayed scenario already in the next few years. With nickel, the point at which projected demand would outstrip projected supply is further into the future but it does happen. Also the projected increase of nickel demand in terms of total nickel supply points in the direction of potential bottlenecks. For copper, global demand is not expected to outstrip global supply but the sharp increase in transition demand in terms of total supply could still cause market disruptions. The rate of increase under the ‘Delayed Transition’ scenario excluding EVs between 2030 and 2035, with the annual demand increase as a proportion of supply increasing from 4.73% to 35%, may have substantial implications for the price of copper. Furthermore, because copper is one of the most widely used materials across a typical advanced economy, sudden increases in demand will likely translate to higher prices.

“Net Zero” associated with near-term demand pressures, “Delayed Transition” mostly after 2030

The paper finds that for all three metals the ‘Net Zero by 2050’ scenario presents near-term demand pressures, whereas the ‘Delayed Transition’ scenario has less demand pressure prior to 2030, but creates significant pressures because of the abrupt increase in demand after 2030. Under both scenarios, it finds that the increase in the rate of annual demand increases could present substantial challenges for the supply-demand balance.

Comparison with fossil fuels only goes so far

A fundamental macroeconomic lesson from our experience with volatile fossil fuel prices is the heterogenous impact on producing and consuming economies. The most proximate example of that divergent impact was the shock to European gas prices in the last 12 months. In this case, gas exporting economies such as Norway benefited from a favourable terms-of-trade shock and importers such as Germany suffered a negative terms-of-trade shock. Adverse temporary price changes can be cushioned by counter cyclical fiscal policy, as was the case in Europe, but permanent changes, such as the shift in demand for transition critical minerals, require structural changes in the economy, which possibly includes a currency appreciation for the exporting country and depreciation of the importing country.

The transition to net zero will create winners and losers. The net balance for each economy will depend on the endowment mix of each country but, in general, fossil fuel exporters and importers of critical materials will suffer a negative terms of trade shock and fossil fuel importers and critical mineral exporters will enjoy a favourable terms of trade shock (see for more details).

That said, there are important differences in the fossil fuel market and transition critical materials. To start with, the consumption of fossil fuels is continuous throughout use of the equipment, so for example, for heating or cooling homes or for transportation. The demand for critical minerals, by contrast, is restricted as an input into key infrastructure such as solar panels, the electricity grid, wind turbines or an electric vehicle. The difference is important for the manner in which price shocks permeate through into the economy. In the case of fossil fuels, such as gas or oil, the passthrough into the import and export price deflator is quick and close to 100% with further consumer prices knock-on effects, which also tend to be fairly quick. Shocks to the price of critical materials will also pass through into the trade prices but the knock on effects are largely restricted to the price of capital equipment. The passthrough to consumer prices will be significantly smaller than an equivalent sized shock to fossil fuel prices.

The results for the two NGFS scenarios reported in Miller et al (2023) are broadly in line with our priors. To start with, and as might be expected, inflationary pressures emerge over a shorter time horizon under the ‘Net Zero by 2050’ scenario, while the ‘Delayed Transition’ scenario would likely bring greater inflationary impacts over the longer term. Also, consistent with our priors, the paper points to relatively small inflation effects. For example, for the Euro Area, Landau & Skudelny (2009) estimate that a 10% increase in industrial raw material prices could lead to a rise in Euro Area core inflation by 0.15% over a 3-year horizon. Besides the effect on price trends, there is also the issue of increased short-term volatility in prices of TCMs. Excess volatility can create uncertainty.

Bottlenecks may cause policy challenges and operational delays, particularly for low carbon tech production

The scarcity of TCMs could also hamper the realisation of the transition, if scarcity of TCMs delays production of low carbon technology. This may delay the decarbonisation of the global economy and raise the potential for transition risks that jeopardise the realisation of a Paris-aligned transition. Transmission of the bottlenecks on a micro level would be through operational disruptions and increased inputs costs, especially for low carbon tech production.

It is worth emphasising that the transmission channel into inflation of these supply-demand imbalances are different from those that emerge from a more conventional supply shock such as from oil or gas prices. An oil price shock for an importing country typically has an immediate impact on inflation. By contrast, the volatility and scarcity of critical materials could, as discussed above, have a negative impact on the productive capacity of the economy, and therefore a more persistent form of inflation.

How a country fares in this is dependent on a) the presence in this country of main TCMs in abundance b) the country’s ability to move up the value chain in the production of TCMs (ie from mining to refining, from refining to manufacturing). TCM bottlenecks could impact the balance of payments of both exporting and importing countries.