ESG Economist - Dutch balancing challenge in the renewable era

Considering the surge in renewable capacity to meet climate goals, a new challenge is facing power market operators, namely grid balancing. This is because of the intermittent nature of renewable generation, which makes supply vulnerable to weather conditions, especially in the absence of sufficient grid and flexible capacity. In such a case, curtailment and negative prices episodes become more frequent, along with frequency swings, which induces blackouts and economic costs. Furthermore, such situation would discourage investments and slowdown the transition process. The recent nation-wide blackout in Spain and Portugal put this challenge in the spotlight raising concerns about energy stability and security across Europe. This article dive into this topic with a focus on the Dutch case. We revisit the current and envisioned power mix in the Netherlands. We further explore the challenges, risks and opportunities facing development of flexible technologies in the Netherlands. We end with recommendations.

The Netherlands targets a 72% emission reduction by 2030 and CO2-free power by 2035, heavily relying on solar and wind energy

The Dutch goals include eliminating coal power by 2029 and increasing renewables, emphasizing the need for robust grid management

The Netherlands faces significant challenges in maintaining supply security as controllable generation decreases, relying more on imports and battery storage

Interconnections play a critical role in balancing the grid, with electricity imports from neighboring countries helping stabilize supply amid renewable fluctuations

Grid flexibility is vital to prevent blackouts, with TenneT expecting battery capacity to expand by 7.2 GW by 2033 to maintain supply security

Battery Energy Storage Systems (BESS) face location and tariff challenges in The Netherlands; flexibility through new tariffs starting 2025 may improve their business case

Blackouts pose major economic risks, with the Dutch Value of Lost Load (VoLL) estimated at EUR 68,887 per megawatt-hour, stressing the need for reliable systems

Dutch goals for renewable power

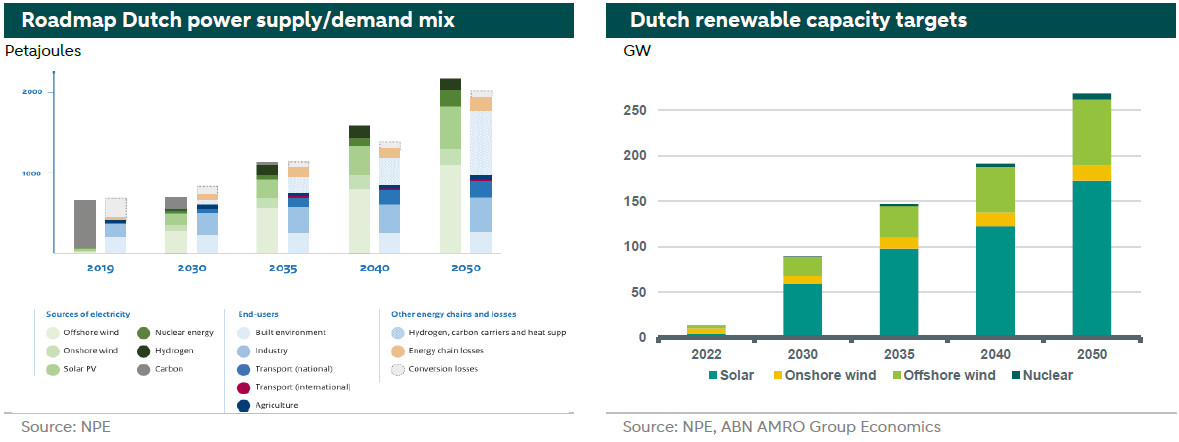

The Netherlands has ambitious transition targets for its power sector with an emission reduction goal of 72% by 2030, compared to 1990 emissions, reaching a CO2 free power sector by 2035. To achieve these targets, the Netherlands plans a simultaneous phasing out of conventional fossil-based power production and scaling up of renewable capacity, as shown in the left chart below. The chart displays the roadmap of the Dutch electricity mix according to the National Plan for Energy (NPE), both for the supply and the demand side. In particular, the Dutch ban on coal guarantees no coal power generation after 2029, marking a major milestone in the Dutch transition. Solar and wind power are the main pillars of the Dutch future energy mix. Currently, there is more than 11.7GW of wind installed capacity in the Netherlands. Solar capacity is more than double that number with 24GW of installed capacity in 2024.

More precisely, the Dutch government set ambitious capacity targets for solar and wind (both onshore and offshore), as shown in the right chart below. The chart further emphasizes the role of solar and offshore wind in the future of the power sector in the Netherlands. Meeting the Dutch targets for offshore wind is facilitated by its unique access to the North Sea, which has the advantage of shallow waters, strong winds, and the proximity of important ports and energy consumers.

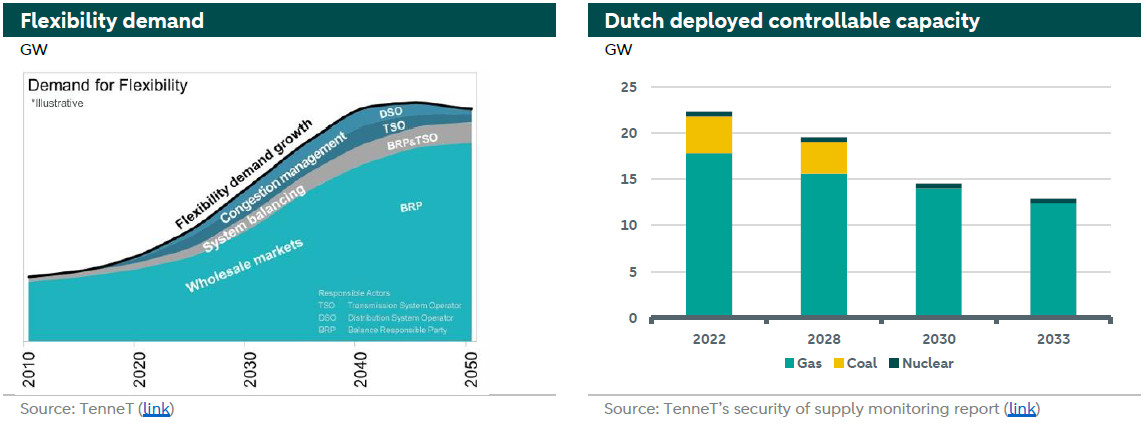

However, achieving these targets is faced with different emerging challenges. As we transition from one energy mix to another, there are all kind of mismatching that could emerge which are associated with different kinds of risks and costs. More precisely, with an increase share of renewables in the electricity mix, grid flexibility become crucial to smooth-out supply intermittency, reduce curtailments and negative prices, along with decreasing the risk of blackouts. Particularly, the latest security of supply report by TenneT () highlights major concerns about electricity supply security in the Netherlands by 2033, where rising demand and increased reliance on renewable energy sources, like solar and wind, are key factors.

Flexibility options

Grid flexibility can be expanded through many ways. First, an increase in the overall grid capacity, which reduces congestion in the network and facilitates the transportation of generated renewable power to where the load is (read more on Europe’s grid problem in our earlier publication here). Second, grid scale batteries can help shift generated renewable power between low and peak times. These batteries could take many forms such as hydro pumps, electrochemical, thermal batteries, or others. You can read more about grid scale batteries in our earlier publication here. Third, demand flexibility, or demand response, is a way to optimize grid capacity and management by encouraging industrial and final consumers to shift their demand away from peak hours to times with excessive electricity supply or lower demand through various incentive schemes (see our previous publication on the role of demand response here). Fourth, in the long term, nuclear power can play a big role in flexibility services. The Netherlands aims to increase Nuclear capacity but there are multiple challenges associated to this, such as the cost uncertainty, location, long time horizon for completion (see our earlier note on nuclear power here). Fifth, the digitalization of power grids increases the flexibility in the grid by increasing efficiency in electricity production, lower network losses, and extended lifetimes for power plants and networks (Read more here). Sixth, fossil based balancing technologies could also be of use. This has been the case in many European countries, where gas and coal power plants were used to fill in the supply deficit especially when renewable output plunges due to slow wind or cloudy skies. Finally, flexibility should also be seen in a wider geographical context. Most importantly are the interconnections with neighboring countries which facilitate the exchange of power across the borders. For example, the Netherland imports electricity from Norway which has abundance in hydroelectricity. Hydropower provides a reliable renewable supply that is not vulnerable to weather conditions as is the case for wind and solar power.

Each of these options has a role to play in the grid balancing challenge for the Netherlands. However, the availability of controllable generation is decreasing, with coal plants phasing out by 2030. More precisely, the country will rely on imports, gas plants, and battery storage for flexibility services. But gas plant capacity is also expected to fall from 12.5 GW to about 9 GW by 2033, creating supply security risks. Thus, increasing flexible capacity becomes a priority as illustrated in the charts below.

Along with regional interconnections, grid scale batteries are at a high technical readiness level with substantial cost reductions to be at the forefront to fill the flexibility needs. Converting excessive renewable power to gases such as hydrogen or to heat to be used in buildings and industry are also essential flexibility options for the Netherlands.

Current interconnections with neighbouring countries

Resource adequacy refers to the sufficient electricity supply to meet national electricity demand. Imports, especially from Northwest European countries are essential to resource adequacy for the Netherlands in coming years. Mutual dependance with these countries is key to address uncertainties moving beyond 2025. There is a standard 4 hours per year shortage of electricity supply in comparison to demand, which is not expected to be exceeded in 2025, according to TenneT[1]. However, as we move forward with the energy transition, power consumption will increase in almost all countries, dependency on renewables will increase as well, which make the system more sensitive to weather conditions.

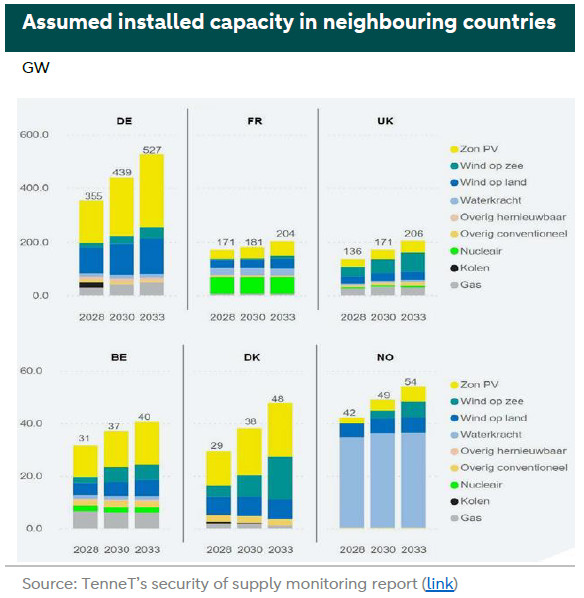

The Netherlands and neighboring counties are moving toward more renewables and less fossil based electricity mixes as illustrated in the chart above, which increases the chances of a simultaneous occurrence of shortages or surpluses in the Netherlands and abroad. For example, in neighboring countries some nuclear power plants are scheduled to shut down. In others, the prioritization of national needs could affect the reliability of flexibility services. For instance, as mentioned above, The Netherlands relies on imports from Norway to fill in supply shortages when needed. However, Norway has been witnessing a rise in domestic power prices because of its power exports to other European countries, making it a prominent agenda points for many right-wing parties in Norway. The price development in Germany also affects those of the Netherlands. Germany share of wind power has been rising significantly in recent years. The country has been witnessing swings in electricity prices many times this year due to a plunge in wind blow. Additionally, the limited German electricity grid transmission capacity has been insufficient to match the imbalanced demand between the Northern and Southern states, nor does it allow for a sizable electricity trading between its neighboring countries. To solve this issue, Germany is considering splitting the market into two electricity price zones which would reduce the redispatch costs and grid charges for consumers.

These trends highlight the importance of coordinating the speed of progress for different components of the power market and between The Netherlands and its neighboring countries.

The need for extended grid capacity

Limited grid capacity is a major obstacle for developing renewables and storage in many countries, as projects can't proceed without securing grid connections. Long queues for grid connections are common, with countries like Germany and France requiring projects to obtain planning permission before requesting a connection, shifting from a "first come, first served" to a "first ready, first served" approach. Additionally, rising connection costs are causing some projects to be canceled.

In much of the Netherlands, the electricity grid is so congested that new large consumers, like companies, can't be established until grid reinforcements are completed or more flexible grid usage is implemented. Furthermore, many Dutch companies and households face long waiting lists for grid connections, with Netbeheer Nederland reporting 7,583 unique connection requests. The Energy Transition Commission suggests that electricity networks must expand to approximately 120 million km from the current 68 million km. BloombergNEF estimates that $21.4 trillion is needed globally by 2050 for grid investments to achieve net-zero emissions, while the European Commission estimates EUR 584 billion is required this decade for grid updates and extensions.

Envisioned flexibility capacity

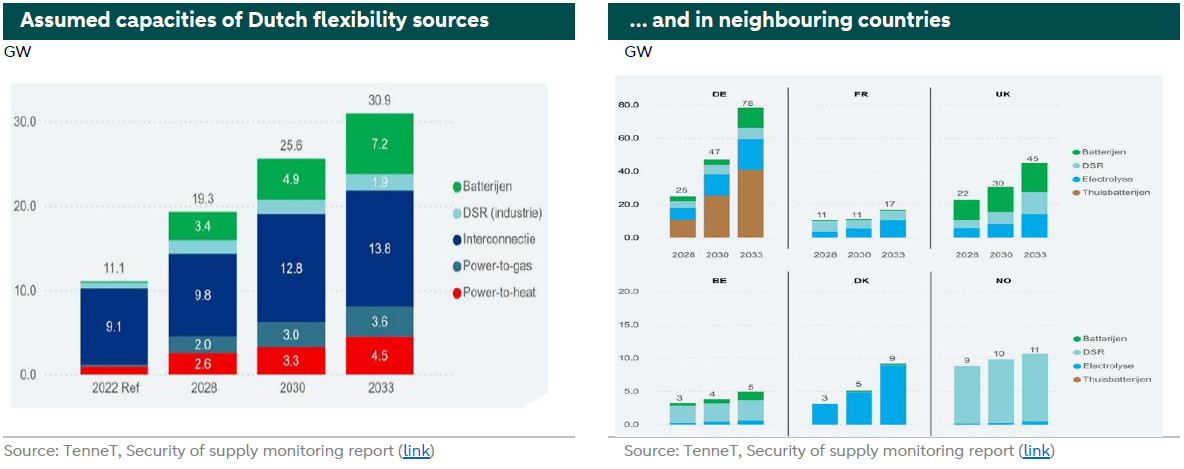

TenneT highlights the importance of interconnection investments which represent the largest share in the flexibility future capacity, as illustrated in left chart below, which depicts TenneT’s assumed needed capacities for Dutch flexibility sources up until 2033. Batteries come next followed by Power to X measures and industrial demand response, respectively. These estimates are associated to several uncertainties especially those related to technical development and readiness (reliability and properties), business case, and the political climate (regulations, frameworks, concrete objectives).

The right chart below features the flexibility assumptions for neighboring countries, where Germany is envisioned to have the largest flexibility capacity as the country rely more and more on renewable sources in their electricity mix.

Cross-border interconnections are vital for the Netherlands' energy future, but they come with uncertainties. By 2033, the interconnection capacity is expected to reach 13.8 GW, including the LionLink cable to the UK. This capacity is crucial for meeting power needs that can be controlled. However, the actual availability of this power during shortages isn't guaranteed due to competition with other countries and geopolitical risks. Additionally, political debates in neighboring countries about whether to integrate electricity markets could affect the reliability and use of these interconnections. Accordingly, while these connections are essential for supply security, their effectiveness depends on broader regional and political factors.

In addition, the security of supply report outlines sensitivity analyses conducted for the year 2030 to evaluate the impacts of reduced controllable power capacity in the Netherlands and abroad. These analyses address uncertainties in the pace of developments within the power sector, such as the faster decommissioning of gas units in the Netherlands and less-than-expected capacity additions abroad, particularly in Germany. The analyses focus on a limited number of failure scenarios to estimate the effects on supply security, emphasizing the differences between original scenarios and sensitivity outcomes rather than absolute results. Specifically, the report simulates the removal of an additional 1.6 GW of regulable power in the Netherlands and a decrease of 6.5 GW in Germany's gas power plant capacity, revealing the potential negative impacts on supply security under these adjusted conditions. The report concluded that up until 2030, the Dutch resource adequacy will be within the standard. Beyond 2030, there will be an increase in resource adequacy risks and the standard will be largely exceeded as indicated by the resource adequacy report (see ). More precisely, the yearly Expected Energy Not Served (EENS) will be around 49.8 GWh, while the Loss of Load expectations (LOLE) will be 14.4 hours in 2033, far above the current 4 hours standard[2]. This suggests a heightened risk of electricity shortages, which could lead to blackouts if sufficient controllable power and flexibility measures are not effectively implemented.

The development of battery storage in The Netherlands

As discussed above, the development of storage capacity is essential for grid stability and sustainability. However, there are still several obstacles associated to investments in Battery Energy Storage Systems (BESS) in the Netherlands, those relate to technological limitations, regulatory hurdles, and initial costs.

BESS are seen as a complementary solution for flexibility in the Netherlands. They provide a short-term flexibility. By 2033, TenneT expects battery capacity to grow to 7.2 GW, but this capacity can't fully address the demand for controllable power, especially during extended periods of low solar and wind energy production.

There are several factors that explains the low expected capacity for BESS. First, finding a good location for these systems is governed by several policies. The substation policy requires BESS to be at least 50 meters from TenneT station boundaries, away from lines or cables, and not in areas planned for future expansion. Ideally, BESS should be close to substations to minimize cable length, considering safety. At the same time, the grid topology policy prioritizes placement near wind, solar farms, or industry to match high production or demand areas. Additionally, BESS capacity in high-voltage grids (110/150 kV) must align with local generation and consumption to avoid capacity constraints.

Second, revenue streams for BESS could come from operating in different markets, such as wholesale, congestion and balancing markets. However, in many cases operating in one single market is not profitable and optimizing the asset backed optionality value of BESS in all market segments could make the business case better. An improving factor to economic viability over time would be the ongoing battery cost reduction. But, with increasing amount of BESS in the system, volatility in wholesale markets will be reduced along with the business viability of BESS.

Third, transmission tariffs in the Netherlands have been a dragger to BESS business case as they do not fully compensate for adjustable capacity. However, starting January 2025, TenneT's new time-based transmission tariffs will alter the business case for BESS. From April 2025, the Alternative Transport Rights (ATR85/15) will offer free kWcontract with 85% availability. Utilizing ATR85/15 and time-based tariffs, flexible grid users like batteries can achieve up to a 65% discount, aiding grid balance without adding congestion. TenneT expects this tariff change to enhance the viability of grid batteries and support BESS development, though investment decisions should be carefully evaluated to prevent impacts on grid rate affordability.

Blackout costs and challenges for the Netherlands

The recent nation-wide blackout in Spain and Portugal raised concerns about energy stability and the possibility of such events across Europe. The blackout began with a rapid loss of solar power in southwest Spain, followed by additional supply losses and the disconnection of the Spain-France interconnection, which isolated the Iberian Peninsula and led to a system-wide collapse. Spain's dependence on renewable energy without the stabilizing inertia of traditional turbines, combined with inadequate grid investment and battery storage, exposed vulnerabilities. The disruption critically isolated Spain and Portugal, causing severe imbalances, particularly as Portugal lacked energy storage and relied heavily on imports. In a recent report, the government indicated that the grid operator, Red Electrica (REE), did not secure adequate voltage control resources, leading to improper disconnections of some power plants. REE admitted that over-voltage was a factor but blamed non-compliant power plants and unusual circumstances that exceeded normal security criteria. All in all, the unusual grid frequency oscillations prior to the blackout indicate stress and underscore the need for improved resilience and planning.

Similarly, a blackout in the Netherlands can happen when the balance between electricity supply and demand is disrupted. This might occur if there is a sudden increase in electricity demand that exceeds what power plants can supply, especially during peak usage times or extreme weather. Blackouts can also be triggered if key parts of the electrical grid, like power plants or transmission lines, fail unexpectedly, causing widespread outages. As discussed above, the grid's complexity increases with renewable energy sources like wind and solar, which can be unpredictable and may not always have enough backup from controllable sources especially those coming from neighboring countries. Additionally, external threats such as cyber-attacks, technical issues, or geopolitical conflicts affecting international electricity connections could lead to a blackout. To prevent this, effective grid management, maintenance, and emergency planning are essential.

We note that restarting the system after a nationwide blackout involves a complex and time-consuming process due to several key factors. Grid stability must be achieved first, requiring careful synchronization of power generation with demand to prevent further outages. Equipment checks are essential, as power plants and substations may need repairs before safely restarting. Load management is crucial to avoid overloading the system, necessitating a phased power restoration that prioritizes critical infrastructure, such as hospitals. Effective communication and coordination among utility companies, government agencies, and emergency services are vital for a safe and efficient restoration process. Safety protocols must be implemented to safeguard personnel and the public, while the technical complexity of modern electrical grids demands specialized expertise to address the intricate procedures involved in restarting interconnected components. These technical, logistical, and safety challenges collectively contribute to the extended duration required to restore power after a nationwide blackout.

Finally, the Dutch Consumer & Market Authority (ACM) estimates the Value of Lost Load (VoLL) to be around EUR 68,887 per megawatt-hour. This figure represents the highest price consumers would be willing to pay to prevent a shortage. This number indicate that the economic impact of a blackout could be considerable, potentially amounting to tens of billions of euros each year when factoring in the wide-ranging effects on businesses and households.

Recommendations

The security of supply report lays down several recommendations for the Netherlands. To ensure supply security and minimize reliance on imports and costly demand-side management, a capacity mechanism is recommended to maintain regulable generation capacity, particularly for gas plants. Creating flexibility in the energy system is urgent, with potential shortages indicated by projections exceeding the LOLE reliability standard by 2033. Suggested measures include providing subsidies for hydrogen-compatible gas plants and nuclear power to address financial viability challenges faced by gas plants due to fewer full-load hours and volatile energy prices, which risk closures. Implementing capacity mechanisms, as seen in neighboring countries can mitigate social costs. These mechanisms compensate providers for maintaining adjustable capacity, balancing short-term flexibility with long-term sustainability, and reducing the need for expensive demand-side management.

[1] TenneT is the electricity transmission system operator (TSO) in the Netherlands.

[2] LOLE and EENS are the main indicators of security of supply. The Loss-of-Load Expectation (LOLE) represents the expected value for the average number of hours per year that demand will not be able to be met. While The Expected Energy Not Served (EENS) provides an insight into the extent of the occurred scarcity. It represents the annual expected amount of energy that cannot be delivered and is represented in MWh or GWh.

please go for links in graphs to the document