Gas Market Monitor - Winter approaches and gas markets exhale

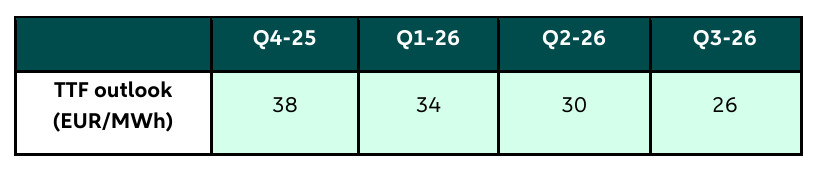

Europe has filled 83% of gas storage, boosted by lower Asian LNG competition, increasing confidence for winter. Despite this, supply constraints persist until early 2026, when new capacity from the US and Canada is expected to ease the market. European industrial demand weakens amid global economic slowdown and tariffs, with recovery expected in 2026 due to fiscal stimulus. TTF prices remain sensitive to Middle East or other peace talks, sanctions, US-China trade war, and supply disruptions. Our outlook for Q4 year ahead contract to average around 38 EUR/MWh before easing in 2026.

Introduction

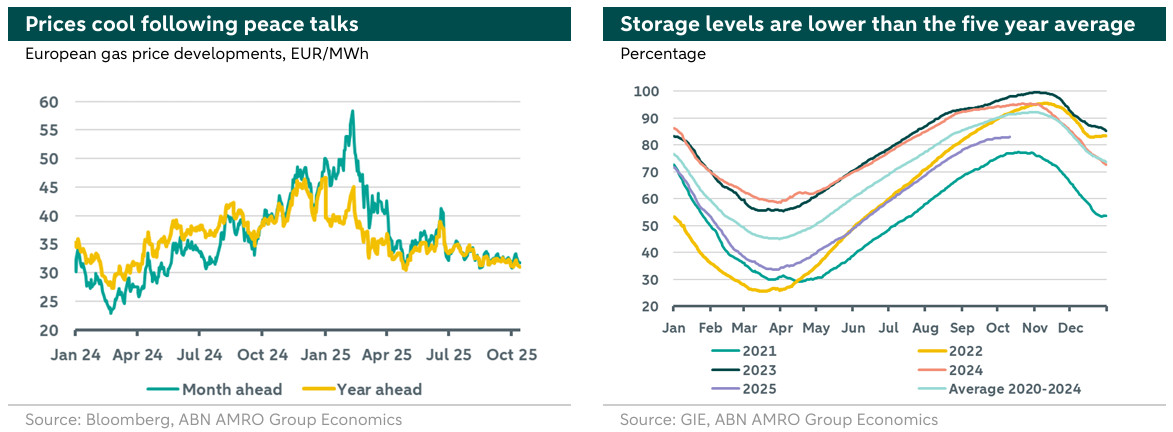

In Q3, the European TTF benchmark averaged 33.8 EUR/MWh for the month-ahead contract and 33.5 EUR/MWh for the year-ahead contract. Prices remained fairly stable during the summer refilling season, fluctuating between 31 and 35 EUR/MWh, supported by lower competition for LNG cargos from Asia, particularly China, and favorable weather conditions. This has boosted confidence that Europe's will be able to replenish inventories in a timely manner. By mid-October, storage levels had reached 83% of capacity. However, during the heating season, the LNG market remains tight and TTF prices will be highly sensitive to geopolitical events and adverse weather. We expect the market to ease when new capacity from the U.S., Canada become online in 2026. Currently, TTF month-ahead contracts are trading around 31.7 EUR/MWh.

European gas market developments

Europe is doing very well in terms of replenishing its gas storage compared to what was expected couple of months ago. It was able to fill 83% of its storage capacity at the time of writing. Sufficient storage is an important buffer for supply distortions as we enter the heating season. Lower competition for LNG cargos from Asia, especially China, has played an important role in this. Furthermore, the European Commission's new summer agreement allows the 90% gas storage target to be met between 1 October and 1 December, replacing the strict 1 November deadline. This, along with flexible refill paths and adjustments for market or technical challenges, has eased market participants' concerns. We note that this year is considered the last year of tight LNG market as new capacity is expected to become online in 2026 both in the U.S., and Canada, while the government of Qatar plans to increase LNG production capacity to 126mn tonnes per year (Mtpa) by 2027 versus the current 77 Mtpa.

Geopolitical developments remain a key factor influencing TTF prices. As hopes for a peace deal between Russia and Ukraine diminish, the US imposed a 25% secondary tariff on India. This tariffs aim to pressure India into reducing Russian energy imports. But this strategy has so far failed as India continues its purchases. Meanwhile, the US urged the EU to further cut its reliance on Russian energy, prompting the EU to introduce the REPowerEU roadmap. This plan includes banning new Russian LNG contracts from 1 January 2026, ending short-term imports by 17 June 2026 (with exceptions for landlocked countries until 2027), and halting all long-term imports by 2027. The roadmap is expected to increase the EU's dependence on LNG from suppliers especially the US and Qatar. Furthermore, the escalating conflict between Moscow and Kyiv has heightened risks, as the two countries keep targeting energy infrastructure. Accordingly, Ukraine announced plans to increase natural gas imports by nearly a third, potentially tightening supplies for the rest of Europe.

Meanwhile, in 2024, China became the world's largest LNG importer, making its ongoing trade negotiations with the US key factor shaping the global LNG market. On that front, over the weekend, the US announced a 100% tariff on Chinese goods in response to China's rare earth export restrictions. These tariffs are expected to reduce Chinese LNG demand, exerting downward pressure on TTF prices.

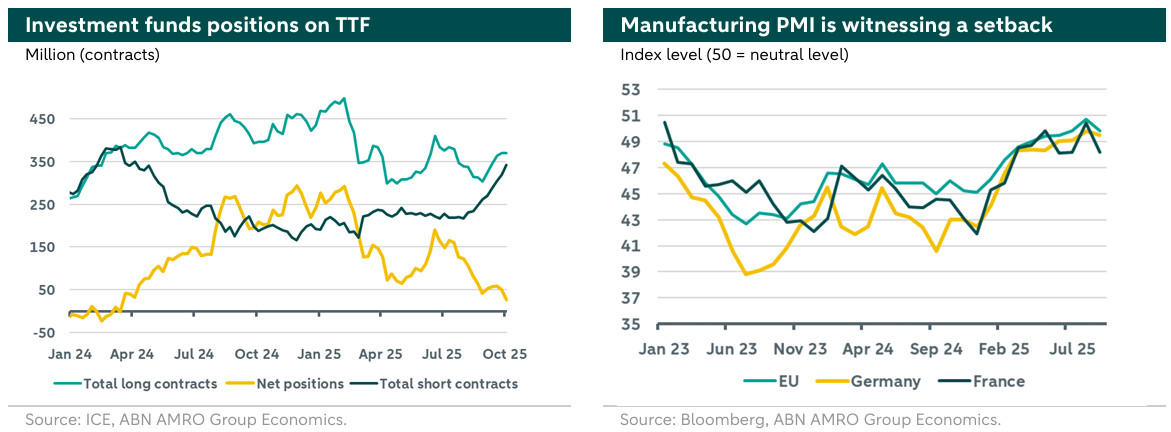

European industrial demand recovery is facing setbacks. Indeed manufacturing PMI for September showed a decline after previous months of moderate improvement. Manufacturing PMI is often a good indicator for LNG demand. We think that the positive effects from front loading ahead of the US tariffs is fading. We expect these tariffs to weigh on industrial demand recovery into late 2025. Despite this we expect the momentum in economic recovery to improve in in 2026, supported by fiscal stimulus from higher defense and infrastructure spending. Overall, even with below average storage capacity, we think that the market is well supplied for this time of the year with an increasing confidence that the continent will be able to survive the coming winter months with limited disruptions. This is reflected by the sharp increase in short positions among investment funds, bringing overall net positions closer to neutrality, as shown in the left chart above.

Outlook

The LNG market is expected to remain tight through 2025 and the beginning of 2026, with relief likely in the second half of 2026 as new capacity from the US and Canada comes online. Thus, in the coming months, TTF prices will remain sensitive to adverse weather, such as cold spells or weak wind, which drive up demand for heating and power generation. We expect demand from the industries to remain weak. Prices will be shaped by the ongoing Ukrainian war, potential new sanctions on Russian energy exports, storage withdrawal rates, and demand trends in Europe and Asia, especially amid uncertainties surrounding the U.S.-China trade war. In addition, supply disruptions from key suppliers like Norway, the U.S., or Qatar could further tighten the market and push prices higher.

Under current market conditions, we maintain our forecast for TTF year-ahead contract to average around 38 EUR/MWh in Q4, slightly below the seasonal average. This reflects tempered seasonal demand due to the anticipated global economic slowdown, driven by the continued impact of US tariffs, which are expected to dampen industrial and power generation demand globally. We note that prices could drop further if the US-China trade war escalates.

For 2026, we anticipate a gradual decline in prices as new LNG capacity from the US, Canada, and Qatar comes online, easing the long-standing market tightness. By next summer, we expect below average price levels to dominate. However, this would be conditional to timely delivery of additional capacity. Delays in launching additional production in the U.S. and Qatar could exacerbate market tightness again and strain global LNG supplies. A summary of our EU TTF year-ahead benchmark outlook is provided in the table in the following page.