The Netherlands - After budget day, on to the elections

The budget presented on Prinsjesdag had few surprises, including a plan to boost purchasing power. Large policy changes were left to the next cabinet after the upcoming elections, and the political campaign is picking up steam. Growth is expected to remain subdued in the near term before picking up in 2026.

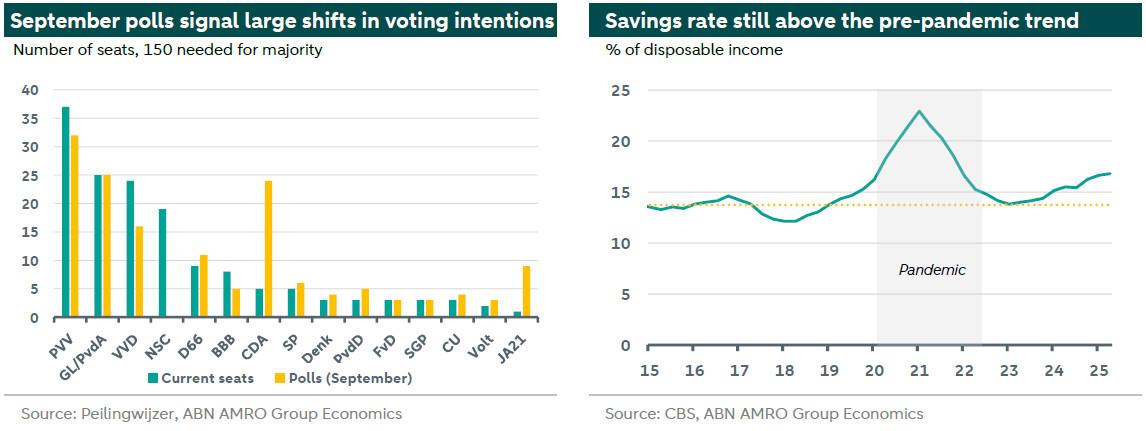

The third Tuesday of September marked another ‘Prinsjesdag’, or Dutch budget day. The budget had few surprises. Firstly, due to the caretaker status of the government a ‘policy light’ budget was submitted, and secondly, because most measures were already leaked. The government plans to boost purchasing power with a slight tax reduction and a 1-year extension of reduced fuel levies, and decided to support the Dutch high-tech sector, with the semiconductor industry as a key beneficiary. There were other measures for public transport, and windfarm subsidies. Notably absent were plans for ramping up defence spending (as agreed during the NATO summit) and addressing long-term challenges such as low productivity growth, the housing shortage, electricity grid congestion, and the nitrogen problem, for which large policy changes are left to the next cabinet after the 29 October elections. While the Dutch economy is showcasing resilience, these structural issues are increasingly constraining economic activity and create policy uncertainty. A new government with a more longer term view would help navigate these challenges. Dutch budget day and the following budgetary negotiations were overshadowed by the upcoming elections. The political campaign is picking up steam, and current polls already indicate some shift away from the previous coalition and towards more centrist parties. As the 2026 budget will be discussed and voted upon by the incoming parliament after the elections, the budget can still be altered. Some opposition parties have already voiced their intention to do so.

Economic growth meanwhile slowed to 0.2% q/q in Q2. The Dutch economy has been gradually losing momentum over the past 4 quarters, and we expect growth to remain subdued in the near term before picking up in 2026. While trade with the US is under pressure due to the introduction of tariffs, recent figures indicate that exports to the US still rose in H1 2025 – likely driven by some degree of frontloading. Notably, re-exports increased by 24.6%, significantly outpacing the 4.5% rise in exports of Dutch produce. As previously highlighted, the unwinding of frontloading appears to be more gradual than initially expected. Nonetheless, we expect tariffs to weigh on Dutch exports in the coming quarters. Both due to less direct exports to the US, and indirectly through weaker demand from the Netherlands’ main trading partners. By contrast, domestic demand is expected to carry growth over the coming quarters. However, so far, household uncertainty is evident in subdued consumer confidence and an elevated savings rate, which indicates a preference for saving over spending. This cautious behaviour is also reflected in the Q2 data, where consumption increased by 0.1% q/q, despite the continued rise in purchasing power. We expect elevated wage growth, a slightly lower savings rate and the announced purchasing power measures to fuel higher spending by consumers in the coming quarters. The labour market remains a supporting factor for households but is showing signs of a gradual cooling. The unemployment rate edged up slightly to 3.9% in August (up from 3.8% in July), primarily driven by increased labour market participation with the participation rate (i.e. labour supply) reaching a new high of 76.3%. Still, forward-looking indicators suggest the labour market is losing some steam. Employment growth is slowing, and the number of unemployed people searching for work for one to twelve months has risen.