US Watch – Trade Wars Episode I: The phantom tariff

• President Elect Trump proposed a 25% tariff on Mexico and Canada to halt migrant and drug flows. China would get 10% because they do not do enough to halt export of raw materials for drug production. The tariff is milder than the universal tariff campaign proposal, but there is no reason it would replace it. The tariffs would hit Mexico and Canada hard.

A mere three weeks after the election, and nearly two months before President Trump’s inauguration, the first explicit threat of tariffs came. In a message posted to his own social media platform, Truth Social, he promised to sign an executive order on day 1 of his presidency, charging a 25% tariff on all products coming into the United States from Mexico and Canada, ‘and its ridiculous Open Borders’. The tariff would remain in place until ‘Drugs, in particular Fentanyl, and all Illegal Aliens stop this invasion of our country’. China would be hit by 10% tariffs above any existing tariffs, until it prevents the flow of drugs into the United States. The proposal comes mere days after the nomination of Bessent for Treasury Secretary, who was received favourably by markets because he’s expected to roll out any tariffs gradually, causing less damage to the economy. A day one 25% tariff on the US’s largest trading partners cannot be considered gradual.

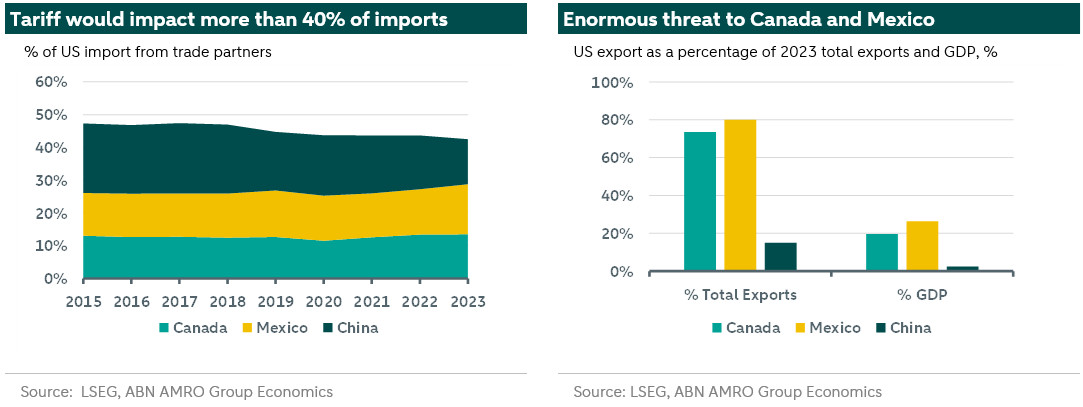

Let’s take the proposal at face value, and evaluate the possible impact. From the perspective of the US, imports from these three countries account for 42.5% of goods imports. The proposal raises the trade-weighted average tariff from about 2.5% to 11% overnight, although this would gradually decrease as trade-flows adjust. This figure is similar to the ultimate trade-weighted tariff assumed in our global outlook, although we assume a gradual and global implementation, with significantly lower average tariffs for all countries but China. A back of the envelope calculation suggests the tariffs would add about 0.9 percentage point to inflation. A significant portion is avoided by the core inflation measure, as energy imports account for over 30% of imports from Canada. Crude oil imports from Canada account for 60% of total US oil imports, making unpopular gas price increases likely. The automotive industry would be hit hard, as it has relied on the USMCA (the successor to the NAFTA) to build highly integrated cross-border supply and production chains. It accounts for the largest value-weighted component of overall trade with the US’ two neighbours.

From the perspective of Canada and Mexico, the tariffs are a hard blow. Exports to the US account for 74 and 80% of all exports of Canada and Mexico, and 20 and 26% of total GDP. Tariffs in the first Trump administration led to a percentage decrease in real consumption of about half the magnitude of the tariff percentage. This very conservative estimate gives a GDP hit of 2.5 and 3.25% to Canada and Mexico, enough to push at least Canada into a recession. Second order effects on dependent industries would amplify the impact. The countries reacted with shock to the announcement of such a strong measure. Canada seemed to try and appease President Trump, while Mexico threatened retaliatory tariffs. China on the other hand reacted mildly, seeing their promised 60% tariff downgraded to a mere 10%, although there is nothing to suggest that this proposal would replace the universal tariff touted during the elections.

We got an early preview of the highly uncertain and volatile trade environment we should expect in the coming years. Governments were scrambling to react, using different strategies to try and deter the tariffs. Importantly, it has become clear that President Trump does not only want to use tariffs to – in his eyes - support the US economy, but also to harm other economies and obtain non-economic goals. We see the current episode as mostly reflecting Trump’s ‘Art of the Deal’; Come with a bold and terrible offer, and hope to land on something sensible. It fits into what Treasury secretary nominee Bessent described as an ‘escalate-to-deescalate’ strategy. In his first term, Trump also threatened Mexico with tariffs in retaliation for the number of migrants crossing the borders. This ultimately fizzled out in 2020, and that is also the likely course for this threat. The missing piece of the information is the status of the campaign promise of universal tariffs to all imports, the phantom tariff scaring all trade partners.