US - Still going strong

In the US, bank lending standards are not quite as tight as we thought, but will still drive a slowdown

The US economy has exhibited remarkable resilience over the past half year. We no longer expect a recession, but still expect a slowdown, which eventually will bring inflation back to 2%

The Fed’s latest Senior Loan Officer Opinion Survey suggests bank lending standards may not be quite as tight as they seemed. This may help explain part of the recent resilience in the economy

We continue to think interest rates have peaked, with rate cuts to start next March

As we describe in this month’s Global View, we have revised our call for a mild recession, and instead now look for a sharp slowdown and a stagnation in the economy later this year. In the meantime and moving into Q3, the economy has continued to perform well above expectations. In particular, nominal retail sales and industrial production surprised to the upside in July, rising 0.7% m/m and 1.0% m/m respectively. At the same time, payrolls growth cooled further, and housing investment indicators pointed to some renewed weakness; being the most interest rate sensitive part of the economy, housing may be feeling the effects of a rebound in mortgage rates. All told, though, the economy has started Q3 on a very solid footing, with the Atlanta Fed’s GDPNow tracker for Q3 standing at an eye-popping 5.8% q/q saar; this will doubtless be revised significantly lower as more data for Q3 comes in (our forecast is for a more mundane 1.8% expansion), but it underlines the continued remarkable performance of the US economy. Against this backdrop, disinflation also continued in July, with both the headline and core CPI rising by a benign 0.2% m/m, and annual core inflation continuing to edge down. We expect falling wholesale used car prices to deliver another relatively benign core CPI reading for August, which should give the FOMC the confidence to keep policy on hold when it next meets in September.

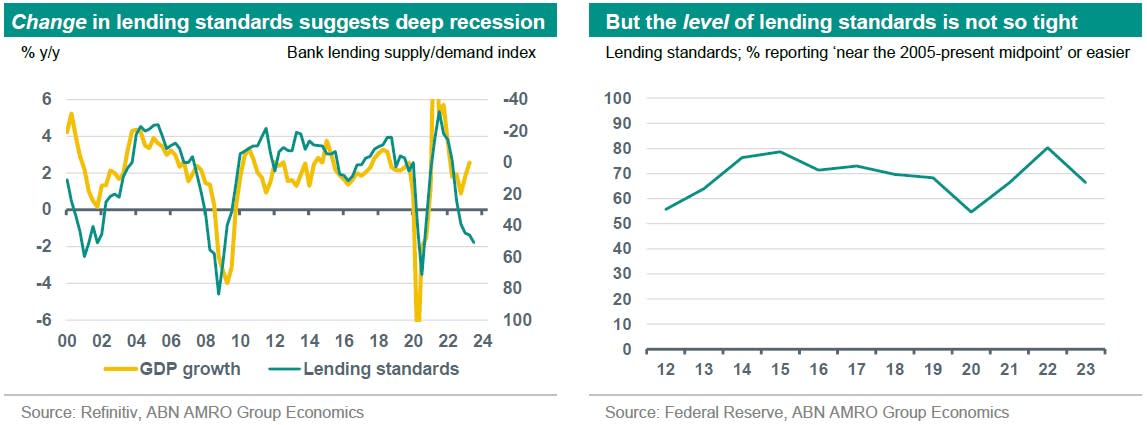

One of the key drivers of our mild recession call was that the Fed’s Senior Loan Officer Opinion Survey (SLOOS) pointed to a major tightening in bank lending standards following the failure of some regional banks earlier this year. The July survey suggested a continued tightening of lending standards. However, another important aspect of the July survey was the special questions asking banks to report on the level of lending standards, not merely the change (as the headline results show). Because lending standards were highly accommodative in the post-pandemic period, even the sharp tightening in standards since then has left lending standards not all that tight after all (see chart below). The tightening in standards is weighing on credit growth, which will eventually hit economic activity, and this is a key reason we expect a sharp slowdown in the economy. However, we no longer think this will be enough to push the economy into a recession.

What does this more benign macro outlook mean for the Fed? Had inflation stayed at the elevated readings of the turn of the year, we would have been minded to expect another round of rate rises and to simply delay the onset of recession. However, the fact that the recent resilience has been accompanied by further disinflation suggests that a significant slowdown will likely be sufficient to cool inflation – though it may take longer to fall back to 2% than we currently expect. We judge that falling inflation is still likely to trigger rate cuts starting next March. As Fed Chair Powell and NY Fed President Williams have repeatedly stated, falling inflation will continue to push real interest rates higher if the Fed does not cut rates next year. Rate cuts would therefore be aimed at keeping policy steady rather than providing stimulus to the economy.

This article is part of the Global Monthly of August 23