US heading for a mild recession

We have lowered our growth and inflation forecasts for the US, with a significantly weaker recovery in investment now expected. Despite this, the tight labour market and inflation worries mean that we still expect the Fed to continue hiking interest rates aggressively. We expect unemployment to begin rising in Q4 this year, with a recession likely to be officially declared in the second half of 2023.

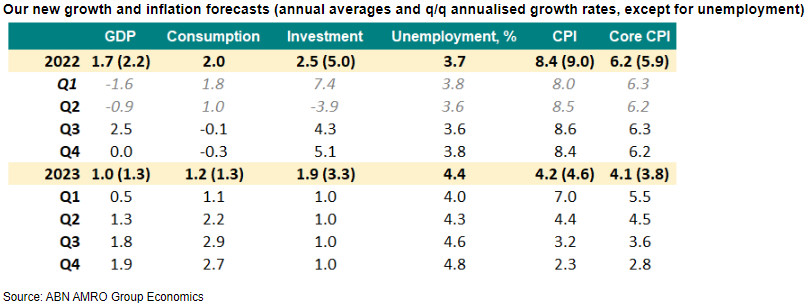

In light of the negative Q2 GDP print and weakening prospects for an investment rebound, we have lowered our GDP forecasts – particularly for 2022 but with a less marked revision for 2023. While the main drag on Q2 GDP was weaker inventory accumulation, an additional factor was unexpected declines in fixed investment – particularly structures and housing. As such, we have significantly marked down our expectations for an investment rebound on the back of pent-up demand in the manufacturing and housing sectors; all told, we have halved our forecast for fixed investment to just 2.5% for 2022, down from 5% previously, and made a more modest downward adjustment for 2023 to 1.9% from 3.3% previously. Our expectation for stagnant consumption in H2 2022 remains broadly unchanged. This takes our overall GDP forecast for 2022 down to 1.7% from 2.2% previously, and to 1.0% from 1.3% previously.

What is driving weaker investment?

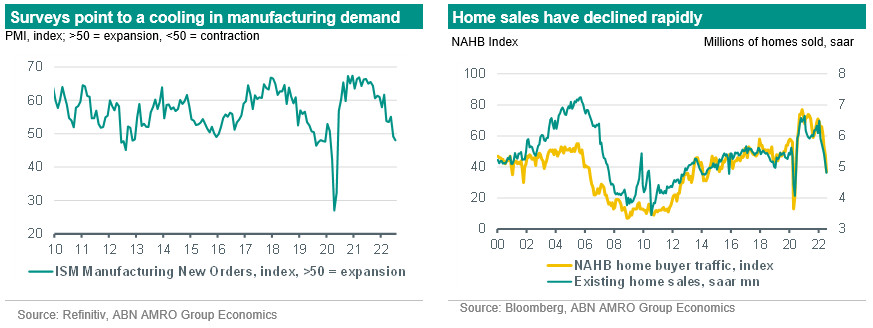

Previously, we expected significant unfilled demand for goods and housing to lead to strong investment growth in the second half of 2022, as supply-side bottlenecks had been the chief impediment to growth. While we still expect some rebound from the negative investment reading in Q2, a range of manufacturing surveys suggests a more rapid cooling in demand than we had previously expected, and combined with higher interest rates and rapid input cost growth, this is likely to mean a much shallower recovery than previously looked likely. For housing, higher mortgage rates have driven a significant decline in demand, evident in both a sharp fall in home sales and in survey-based indicators of incoming buyer traffic. There remains a historic shortage of housing in the US, and this is likely at some point to trigger a renewed rebound in housebuilding, but for the near term housebuilders appear to have been spooked by the softening in demand. Likewise, manufacturers (especially car makers) are caught between continued unfilled current demand on the one hand, and an expected cooling in consumption as the inflation hit to real incomes is increasingly felt. The latter is likely to weigh more heavily in investment decisions, particularly as we move into 2023.

Recession or not? Labour market will be key

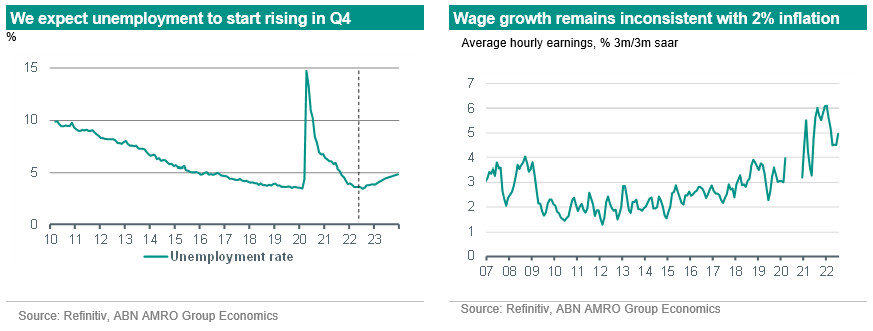

According to the technical definition of two consecutive quarters of GDP declines, the US economy was already in recession in the first half of 2022. However, on most other measures, the economy has clearly not been in a recession – in particular, job gains have continued to be robust, and consumption has continued to grow, albeit more slowly. Given this, the NBER – the official arbiter of recessions in the US – has yet to declare a recession, and is unlikely to do so in the near term. However, looking ahead we do expect the labour market to deteriorate on the back of softening demand, with unemployment expected to begin rising from Q4 onwards. Ultimately, we expect unemployment to rise c.1.5pp to around 5% by end 2023, with the NBER calling a recession perhaps in H2 2023. Note, a recession can be declared even in the absence of two consecutive GDP declines, as we saw in the early 2000s recession.

Labour market tightness and upside inflation risks will keep the Fed hiking until early 2023

Despite the weaker growth outlook and the expected rise in unemployment, we expect the Fed to continue raising interest rates aggressively over the coming months. While we have lowered our headline inflation forecasts somewhat (see table), this is largely on the back of lower oil prices than we expected at this point in the year, with our core inflation forecasts actually seeing a modest upward revision. Indeed, notwithstanding the downside surprise to inflation in July, core inflationary pressures remain very concerning, especially housing rents and medical inflation – components that are typically much more ‘sticky’ than goods and transport inflation. A key pipeline pressure here is wage growth on the back of the tight labour market. The July employment data showed a renewed pickup in wage growth and an upward revision to the June data, taking 3m/3m average hourly earnings growth up to 5% - well above levels consistent with the Fed meeting its 2% inflation target. With the Fed keen to avoid declaring victory in its inflation fight too prematurely, we think it will need to see both lower realised inflation and a cooling in wage growth before it is confident the inflation hump has passed. We are still a long way from that.

As such, our base case remains for the Fed to raise rates in 50bp steps in September and October, with 25bp hikes expected in December and February – taking the upper bound of the fed funds rate to 4%. The risk is tilted towards some of this tightening being further front-loaded, with for instance FOMC voting member Bullard stating in an interview with the Wall Street Journal on Friday that he would favour another 75bp move in September. Beyond the hiking cycle, we continue to expect the Fed to begin reversing course in the second half of 2023, once it is confident the inflation hump has passed, although we expect this process to be gradual and more about bringing policy back to a more neutral setting rather than aggressively supporting growth. Our base case is that the Fed cuts rates in four 25bp steps in H2 2023, taking the upper bound of the fed funds rate to 3% by end-2023.