Germany - Elections and Trump tariffs shape the path ahead

The economy is expected to return to sluggish growth, expanding by 0.7% in 25 and 0.8% in 26. Rising real incomes and falling interest rates mean growth will be driven by domestic demand. Trump tariffs the biggest downside risk: they are likely to hit German exports from H2 2025 onwards. Disinflationary trend to continue, but high wage growth is keeping core inflation elevated. With elections on 23 February, a new government may not be in place before mid-2025. Depending on the election outcome, a step up in fiscal spending is likely given the CDU’s turn.

Growth to turn positive after 2023-24 contractions, but to remain sluggish

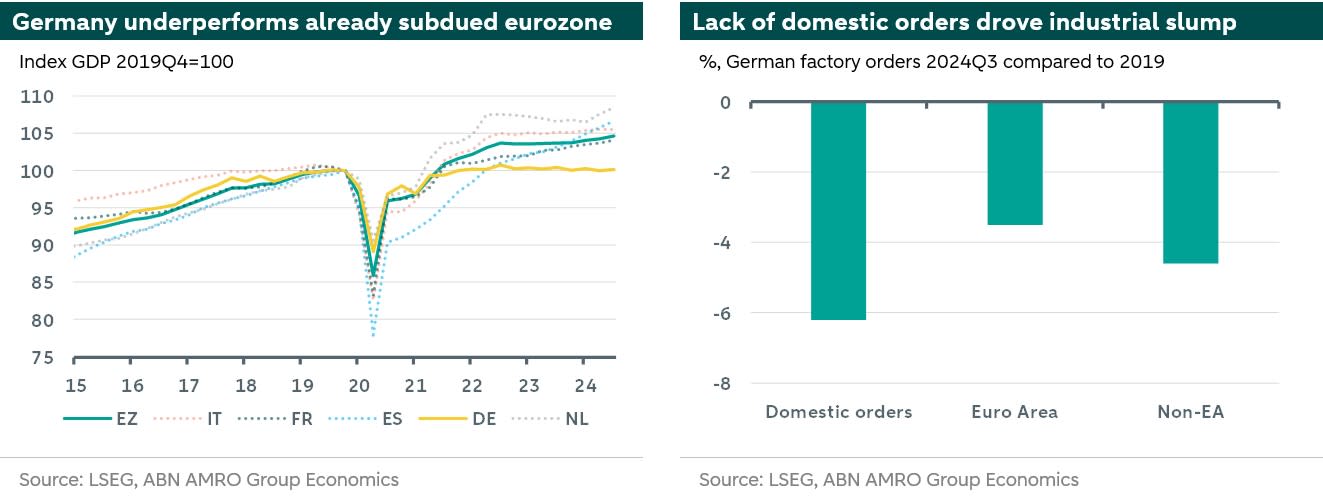

Since the start of the pandemic, the German economy has roughly stagnated (+0.2%), sharply underperforming the broader eurozone, which grew 4.6%. For 2023 and most likely 2024 as well, annual average growth will actually be negative. Looking ahead, and despite political turbulence (see below) moving into 2025, the German economy is expected to see a modest cyclical pick-up in growth in 2025-26. Indeed, rising real incomes, low unemployment and lower interest rates should lift domestic demand, which has been very weak the past 2 years. Investment in particular has room to expand, as it has seen a broad-based contraction, particularly in construction, machinery and transport. As investment typically trails overall GDP, this uptick is likely to materialize over time. ECB rate cuts will help, but the uncertain international as well as domestic political situation will likely keep a lid on the investment recovery.

Similar to other eurozone countries, German households have been reluctant to spend real income gains, but incoming data suggests private consumption has been expanding in the second half of 2024. With further purchasing power increases, due to high wage growth and easing inflation, we expect private consumption to continue expanding in 2025. In contrast to the improving domestic backdrop, the outlook for external demand has darkened on the prospect of new US trade tariffs. Exports to the US are likely to see a significant hit from H2 2025 onwards, although in the near-term the economy might see a lift from front-loading to avoid the tariffs. Export-oriented economies like Germany are disproportionately affected by the tariffs (link). Next to the bilateral impact, an escalating trade spat between China and the US could lead to even more overcapacity in Chinese exporting sectors, raising additional downside risks for eurozone exporters such as Germany (see more below).

A challenge to the German growth model

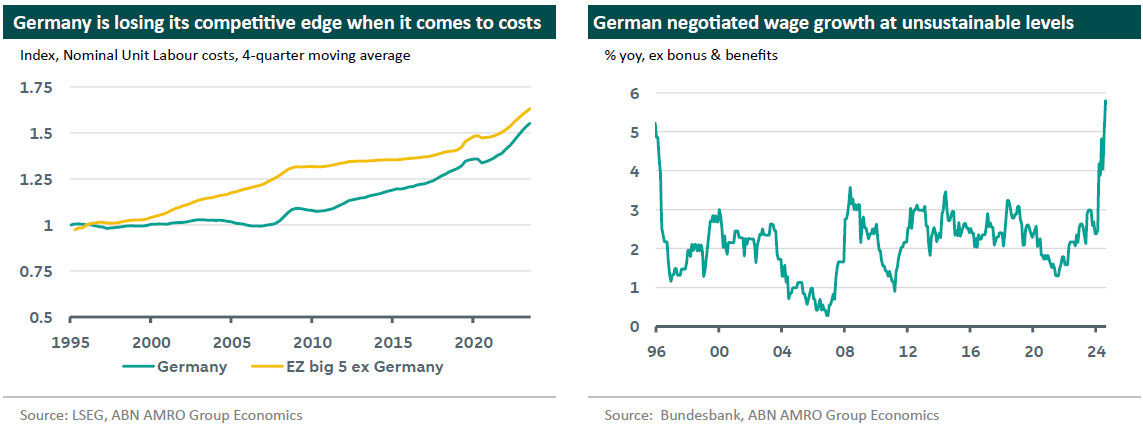

The darkening in the trade outlook comes on top of structural issues that have troubled Germany in recent years. Chronic (public) underinvestment and further out, ageing, are weighing on potential growth, but industrial competitiveness is arguably the biggest worry. In car manufacturing, the biggest challenge has come from rising unit labour costs, as well as China, which has gone from being a supplier and source of demand to a competitor even in home markets (see Special). In other industrial sectors such as energy-intensive chemicals, elevated energy input costs compared to global competitors, constitute an ongoing disadvantage. The result is that Germany’s industrial base is losing global market share, and is unable to export its way out of domestic demand weakness like it could in the past. Industrial activity is expected to see some impulse from the current low base, as lower interest rates stimulate demand for capital goods, directly as well as indirectly via activity in other sectors such as construction. But industry is unlikely to become a major growth engine on our forecast horizon to 2026.

Disinflation to continue while wage growth keeps core inflation elevated

Inflation in October stood at 2% with core inflation higher at 2.9%. Similar to the eurozone, further disinflation is expected for Germany over the course of 2025 and 2026. However, services disinflation will take much longer to return to more normal levels as wage growth is still very high in Germany. Indeed negotiated wage growth is currently at historic highs at 5.8% y/y in August, which seems unsustainable given the recent turn in the labour market. Indeed, notwithstanding the cyclical pickup, the overall subdued growth environment is likely to cause more companies to restructure, leading to a gradual softening of the labour market. This should dampen wage growth – probably significantly (1). Furthermore as workers recoup past purchasing power losses from high inflation – a process that is largely complete – this relieves pressure to demand higher wage growth. Indeed, more forward-looking wage trackers (such as Indeed) already point to a gradual easing of wage growth in the coming months, which should lead to lower services inflation over the course of 2025 as well

New elections on 23 February add to near-term uncertainty, but could ultimately lead to higher investment

The fall of the German government extends the period of policy uncertainty that was already elevated for most of the year, given troubles in the ‘traffic light’ coalition headed by Scholz’s SPD, the Greens and the FDP. With important decisions to be made at the European level, German political instability could have negative spillovers to the eurozone. In the coming months Europe will likely have to: 1) negotiate with the US (and China) on tariffs, 2) decide on support for Ukraine following the US elections, and 3) decide a reform agenda drawing on the Draghi and Letta reports.

There is an upside to draw from the current political situation as well. The coalition fell due to the FDP’s reluctance to relax the debt brake rules, as proposed by SPD and Greens. A new coalition, with a strong mandate, could possibly lead to a step-change in fiscal spending. Friedrich Merz – leader of the opposition CDU and very likely to be Germany’s next Chancellor – recently opened the door to a relaxation of Germany’s strict fiscal rules, as long as this leads to increased investment as opposed to social spending. Public investment has been chronically low in recent years, leading to a lackluster state of infrastructure. Should the new coalition combine higher investment with a broader reform agenda and short term support for the struggling industrial sector, the German economy stands to benefit. All in all, we think the short term impact of early elections due to policy uncertainty will be limited, given that the existing government was already in a state of paralysis. Political instability may negatively impact European policymaking, but the urgency brought on by the election of Trump, and the slow-motion crisis in German industry, might speed up the pace of coalition-building in comparison with the past. Moreover, the election offers an opportunity for a reset with regards fiscal spending. Higher public investment resulting from this poses upside risks to the growth outlook later in our forecast horizon (2026).

While Germany is clearly underperforming, strong balance sheets and a new government could be tailwinds

While the weak state of the German economy has raised alarm bells, all is not lost for the eurozone’s biggest economy. Germany has three clear strong starting points to weather the weak outlook. First, the labour market is tight and while it is expected to soften somewhat, unemployment is expected to stay low, in part due to ageing. Second, demand has been weak in part because households and businesses have favoured deleveraging over consuming or investing. Indeed, balance sheets have profited significantly from deleveraging. This strengthens financial resilience, and creates more room for future consumption and investment. Finally, should the elections lead to a more pro-active fiscal policy by the federal government, Germany has ample fiscal space to make this shift.

(1) Negotiations between Volkswagen and unions point to wage cuts as an alternative to factory closures and job losses.