Eurozone recovery rapidly losing steam; German industry yet to find a bottom

Flash PMIs for September painted a gloomy picture of the eurozone recovery, albeit exaggerated by the Paris Olympics distortions.

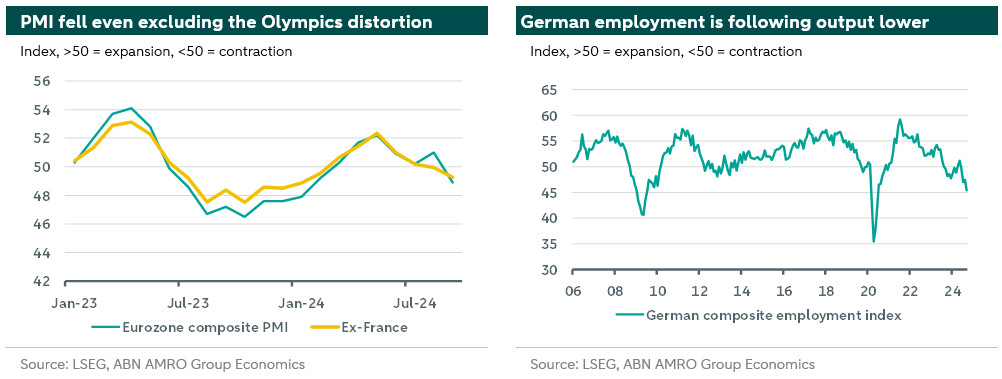

The composite PMI fell a full 2 points to 48.9 from 51 in August. As we had flagged in August, the PMI back then was flattered by a boost from France’s hosting of the Oympics. This effect more than unwound in September, with the French PMI falling particularly sharply, from 53.1 to 47.4. Excluding the impact of this, we estimate the composite eurozone PMI would have fallen a much by a smaller 0.6 points to 49.3.

Despite the French distortion, momentum looks genuinely weak

While the weakness in September is clearly exaggerated by the Olympics distortion, there was little to cheer about elsewhere from the reports. German industry has yet to find a bottom, with the manufacturing PMI falling another 2 points to 40.3 – the lowest since last September. The German services PMI also fell back, to 50.6 from 51.2, and the lowest since March. The labour market also looks to be responding more meaningfully to weakness in demand, with the German composite employment index falling to 45.4 – outside of the pandemic, this is the lowest since 2009 (it will be interesting to see if this is corroborated by German jobless claims data out on Friday). While we do not yet have the full country breakdown with the flash figures, Southern Europe continues to do better than core countries, although S&P Global reported in its press release that “the pace of expansion was only modest and the softest since January.”

Data is likely to give the ECB a greater sense of urgency

Our base case is for the ECB to cut its deposit rate again in October, though recent communications from officials suggest material downside surprises relative to its outlook would be necessary for this. As of its September projections, the ECB expects growth of 0.2% q/q in Q3-Q4. Today’s PMI data suggests the economy may have lost even more momentum than suggested by this forecast, and the Bundesbank last week reported that Germany may even experience a technical recession. While markets have moved this morning to price in a higher probability of an October cut (from around 25% to 40%), we think hurdles remain from the September inflation data and the ECB’s corporate telephone survey, both of which come before the next Governing Council meeting. For inflation, we will get the first indications on Friday with the publication of the French data. We expect this to show a sharp decline in headline inflation, and – importantly for the ECB – most likely a decline in services inflation, as the Olympics effect unwinds. It remains to be seen if this will be enough to tilt the Governing Council towards cutting in October, but today’s data certainly raises that probability.