Eurozone Outlook 2024 - Setting the stage for the first rate cut

The eurozone economy has been stagnant over the past four quarters and growth is expected to remain lacklustre in 2024. Domestic demand was hit by a significant tightening of financial conditions due to unprecedented monetary policy tightening by the ECB, while weak global growth weighed on exports. Inflation has fallen rapidly since its 10.6% peak in October 2022, ending up at 2.4% in November 2023. Core inflation has been more sticky, but is also on a downward trajectory. Wage growth accelerated in 2023, making up for past losses in real income, but deteriorating labour market conditions should result in lower wage growth moving into 2024. Tightening government finances are expected to weigh on growth in 2024.

Growth to remain sluggish for most of 2024

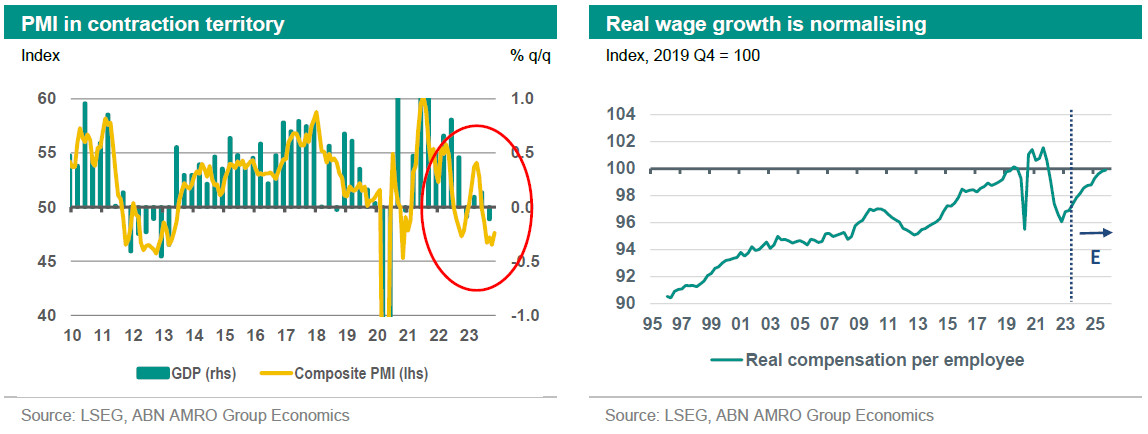

Eurozone (EZ) GDP has been stagnant over 2022Q4-2023Q3, expanding by 0.0% over these four quarters in total. Private consumption and (residential) investment were hit by the unprecedented scale of interest rate hikes by the ECB between July 2022 and September 2023 (by 450 basis points in total). This led to a drop in loan demand by companies and households and has sharply tightened banks’ lending conditions. As the impact of monetary tightening works with a lag, it will still be felt in the first few quarters of 2024, which will keep domestic demand lacklustre. However, we do not expect a long period of contracting GDP. We have pencilled in a 0.2% qoq contraction in Q4, following -0.1% in Q3. Subsequently, we expect GDP to broadly stabilise in 2024Q1 and to grow moderately, at below the trend rate, for the remainder of 2024. Only towards the end of the year, we expect growth to gain momentum and rise above the trend growth rate.

Some factors should prevent a deeper or longer contraction in GDP

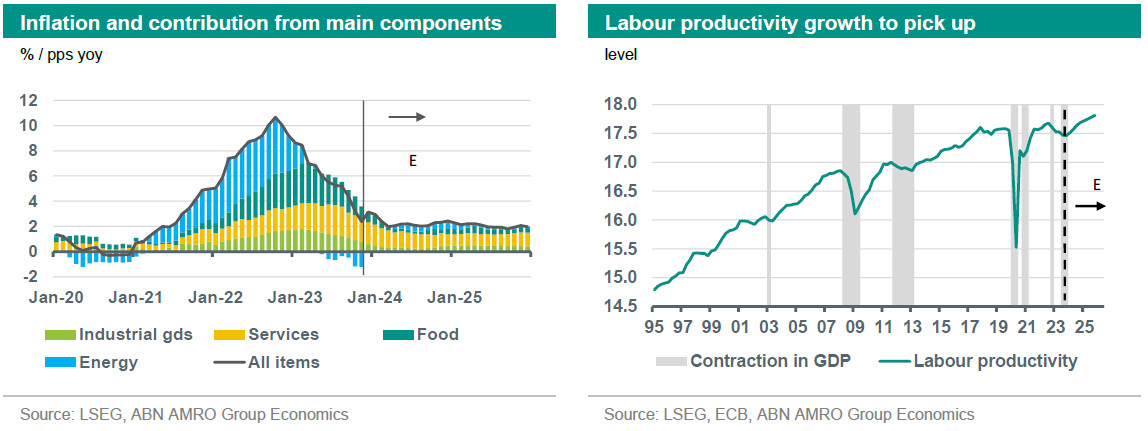

To begin with, we see some early signs of global trade and industry bottoming out at the moment, which should benefit EZ exports and industry, putting an end to the sharp contraction in EZ industrial production that started in the final months of 2022. Next, the end of interest rate hikes by the main central banks has resulted in a rise in consumer and producer sentiment, although sentiment remains relatively weak. The bottoming out of consumer confidence means that households probably will spend a larger share of their income again, after the saving rate jumped higher in 2023H1. Moving further into 2024, the pivot in central bank policy will come into sight (see below). In anticipation of the first rate cut, financial conditions should ease (on some measures, such as bond yields, they already are), which will support consumption and investment further. Also, total investment will continue to be supported by funds from the European Recovery and Resilience Facility (RRF), which are expected to equal around 0.3% of EZ GDP in 2024 and 2025 each (the same as in 2023). Finally, private consumption will benefit from a normalisation in real wage growth, as inflation will drop further. Although we expect wage growth to slow noticeably in 2024, it should still be somewhat higher than inflation (but not to the extent that it would fuel inflation, as labour productivity is also expected to rise – see below).

But other factors should keep a firm lid on growth

To begin with, employment is expected to decline in 2024, which will limit the rise in consumption. Labour productivity collapsed over 2022Q4-2023Q3 and we think this will reverse in the coming quarters, resulting in declining employment and a rise in the unemployment rate. Next, fiscal policy will be tightened significantly in 2024 following the massive government support to companies and households during the pandemic and energy crisis, which resulted in a sharp rise in budget deficits and higher government debt ratios throughout the eurozone. The European Commission estimates that the reduction in support measures will reduce the total eurozone budget deficit by around 0.8 percentage points of GDP in 2024.

Disinflation is well on its way

HICP inflation has fallen sharply since October 2023, when it peaked at 10.6% yoy. In November 2023 it dropped to a lower than expected 2.4% (down from 2.9% in October). Looking at the main components, energy price inflation probably is bottoming out at the moment and we see it moving higher in the coming months. Next, the inflation rates of food, alcohol and tobacco have been falling sharply since March 2023. This decline was driven by a drop in inflation of food commodity prices, and has further to go. Turning to core inflation, services inflation fell more than expected in November (to 4.0%, down from 4.6% in October). There seems to have been some one-off downward effects at play, meaning that there could be some upward payback in the next few months. Finally, the inflation rate of non-energy industrial goods also fell in November, to 2.9% from 3.5%. This part of inflation has been on a clear downward trajectory since the start of 2023, driven by the easing of global supply chain bottlenecks and weak global demand for goods. This trend should continue for a while.

Going forward, we think that headline inflation could temporarily rise again in the coming months, as base effects in energy inflation turn less negative, and there could also be some upward payback for the drop in services inflation in November. More fundamentally, however, we expect all components of inflation besides energy, to continue to weaken during the rest of the year and in the first half of 2024. Weak global and eurozone demand for goods and services will limit demand-side pressures, while the upward impact of higher energy costs on the prices of goods and services will continue to unwind. Finally, we think that wage growth will slow noticeably in 2024, as we already see clear signs that the eurozone labour market is deteriorating. All in all, we expect headline and core inflation to reach the ECB’s 2% target around the middle of 2024.

ECB pivot expected in June 2024

The ECB is expected to keep policy rates at their current level for a while. Based on our outlook for growth and inflation we think that the central bank will implement its first rate cut in June 2024. We expect the deposit rate to be lowered to 2.75% by the end of 2024 and to eventually reach 1.5% in the course of 2025.

This article is part of the Global Outlook 2024