Eurozone - Growth surprise eases pressure on ECB to increase rate cut pace

Euro Macro: Upside GDP surprises across the board, including in Germany

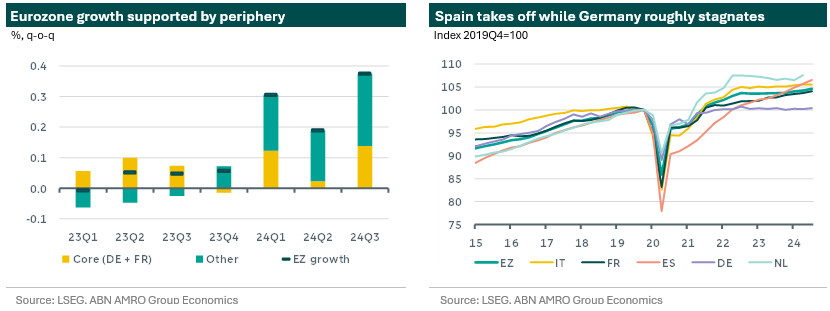

Eurozone GDP surprised to the upside in Q3, with economic growth accelerating to 0.4% (0.2% consensus/ABN) up from 0.2% qoq in Q2. Ahead of the aggregate release the upside surprise was expected as the regional data showed upside surprises in France (+0.4 qoq vs consensus: 0.3%), Spain (0.8% qoq vs consensus: 0.6%) and most notably in Germany. Indeed, German growth surprised to the upside with an expansion of 0.2% where instead a contraction in Q3, following the contraction in Q2 – which would have tipped the economy into recession – was expected. However, while the figure is welcome after several downbeat economic stories over the past months, the headline German figure is likely overstating economic momentum in the Euro Area’s biggest economy for two reasons. First, since the Q2 reading was revised lower to -0.3% qoq from -0.1%, resulting in a lower base. Second, while the link between the PMIs and GDP has become looser since the pandemic, PMIs have signalled a further contraction in business activity over the course of Q3.

Consumers and government pull the economy back up – What has caused the upside surprise? While aggregate details are lacking at this stage, looking at the country details we see that domestic demand in the bloc’s economy has likely expanded in Q3. Household consumption, particularly on services, and government consumption and investment, are the main contributors to growth in big economies such as Spain, Italy, France and Germany. In France, this came despite political uncertainty and was helped by the Olympic boost. The turn-around in consumption comes after a period where weak confidence and lending has instead kept household spending subdued. This is despite conditions for households improving, as labour market conditions remain favourable, while real incomes are rising due to easing inflation and elevated wage growth, as highlighted in our global monthly of September. Contrary to the expansion in private consumption, private sector investment has likely remained a drag on aggregate growth as interest rates remain restrictive (see more below).

Growth expected to stay below trend for the time being – All told, we continue to think the eurozone is set for a subdued recovery. Moving into Q4 we have seen business activity indicators moving into contractionary territory with industry remaining a drag going forward. Furthermore some payback from the Olympic boost is to be expected. We expect the economy to continue growing at modest, below-trend rates in the near-term. Growth should remain at around 0.2% in Q4. We do not expect a more meaningful pickup in momentum until 2025, when the impact of ECB rate cuts is likely to be most felt.

GDP release should ease some pressure on the ECB to step up the pace of rate cuts – The details of today’s GDP release once again highlights that interest rates in the Euro Area are still very much in restrictive territory. Indeed, private sector investment and value added in interest rate-sensitive sector such as real estate and construction is contracting in most countries. Still the upside surprise to GDP – ECB staff projections had growth at 0.2% – and most notably Germany avoiding a recession, takes some pressure off of the ECB to accelerate the pace of rate cuts from 25bp to 50bp, as was suggested by some governing council members in Washington last week. Indeed, the release reinforces our view that the ECB will cut interest rates by 25bp at the December meeting. In 2025 we expect the ECB to continue cutting interest rates by 25bp at each meeting until neutral levels (1.5% in our view) are reached.