Eurozone growth despite German contraction; HICP inflation to edge lower

Euro Macro: Upside GDP surprise driven by Ireland; periphery strength offsets German weakness – Eurozone GDP surprised to the upside in Q2, with the economy growing 0.3% vs 0.2% consensus/ABN (unrounded, growth was 0.259%, only a small surprise compared to our unrounded 0.22% forecast).

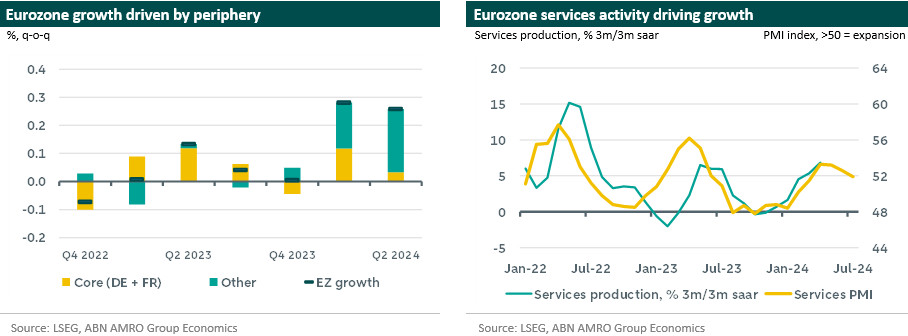

Ahead of the aggregate release, upside surprises in France and Spain were offset by a surprise contraction in Germany (see below). Growth in Italy was in line with expectations at 0.2% q/q. Net exports were a major contributor to strength in France and Spain, but big picture, the data shows a continued divergence between the core and periphery. Southern European countries continue to benefit from record tourist numbers and recovery fund investment flows, while Germany is suffering from persistent weakness in industry. Meanwhile, the surprise in the aggregate figure relative to expectations can be entirely explained by a 1.2% q/q jump in Irish GDP (which tends to be highly volatile); subtracting the impact of this, eurozone growth would have been 0.2%.

Growth expected to stay below trend for the time being

All told, we think the headline for Q2 growth overstates the strength of the eurozone recovery. While services activity continues to benefit from rising real incomes and strong tourist inflows, industry remains in the doldrums, hampered by weak global demand for goods, and continued high interest rates. We expect the economy to continue growing at modest, below-trend rates in the near-term. Growth should remain at around 0.3% in Q3, with a one-off boost likely coming from the Olympics and other major cultural events (see here), but this will be short-lived, with payback likely in Q4 (when we expect growth to pullback to 0.2%). We do not expect a more meaningful pickup in momentum until 2025, when the impact of ECB rate cuts is likely to be most felt.

German contraction the odd one out

German Q1 GDP undershot expectations, contracting by 0.1% qoq (consensus and our forecast +0.1% qoq) after expanding by 0.2% qoq in Q1. The details will be published late August. For now, Destatis pointed to fixed investment, particularly in transport equipment and buildings as the main drag on GDP growth. Indeed, investment in Germany has been generally weak with the level of investment still lagging 2019 levels by about 4%; this is especially the case for investment in transport equipment such as cars. Furthermore, investment in buildings declined after being a source of strength in the Q1 GDP reading. This is not a surprise given the continued high level of interest rates, which have depressed demand and activity in the construction sector, particularly housing.Looking ahead we expect the German economy to return to growth in Q3 again but remain weak. Especially considering the weakened sentiment showcased by the July PMI release (read more here). Zooming out, Germany being the only large economy to contract in the second quarter underlines the widening divergence in economic trajectories between Germany and other eurozone countries.

July HICP inflation expected to edge lower

Partial inflation data was released this morning for Spain, Belgium and the German regions. Inflation came in lower in Spain (falling to 2.8% from 3.4%) and Belgium (to 3.6% from 3.7%), while in the German regions, inflation was broadly stable, and the aggregate is expected to stay at 2.2%. Our forecast for the eurozone aggregate – released tomorrow – is for a drop to 2.3%, which is below consensus for inflation to hold steady at 2.5%. Even a smaller downside surprise relative to consensus will likely spur ECB rate cut expectations. We continue to expect the ECB to resume rate cuts in September.