Energy crisis has disruptive effect on Dutch manufacturing

Relatively high gas prices have been a strong incentive for many industrial companies to rapidly reduce gas consumption. Still, the Netherlands is about 70% dependent on gas imports, so the Netherlands has become a lot more sensitive to gas price fluctuations. It remains important for companies to further rationalise gas consumption. This can be done, for example, by further improving the energy efficiency of industrial processes.

Relatively high gas prices have been a strong incentive for many industrial companies to rapidly reduce gas consumption

In 2022, greenhouse gas emissions in total industry were reduced by 11%, while industrial gas consumption fell by around 25%

Currently, the Netherlands is about 70% dependent on gas imports; thus, the Netherlands has become a lot more sensitive to gas price fluctuations

Compared to the eurozone average, the import price of gas is about 11% higher in the Netherlands

Energy prices rose rapidly from the beginning of 2021. The energy crisis was born. The rapid rise in energy prices stemmed from the rapid economic recovery after Covid-19. Energy stocks and supply - which had been significantly reduced by Covid-19 - could not keep up with the sudden surge in energy demand. Russia's attack on Ukraine in early 2022 exacerbated the situation considerably. The energy crisis had grown into a many-headed monster. In response to the crisis, some European gas-intensive industries stopped production because they could not afford to keep producing. In this analysis, we take a closer look at the disruptive nature of the energy crisis on Dutch industry and consider what the main effects of higher energy prices were, especially those of gas.

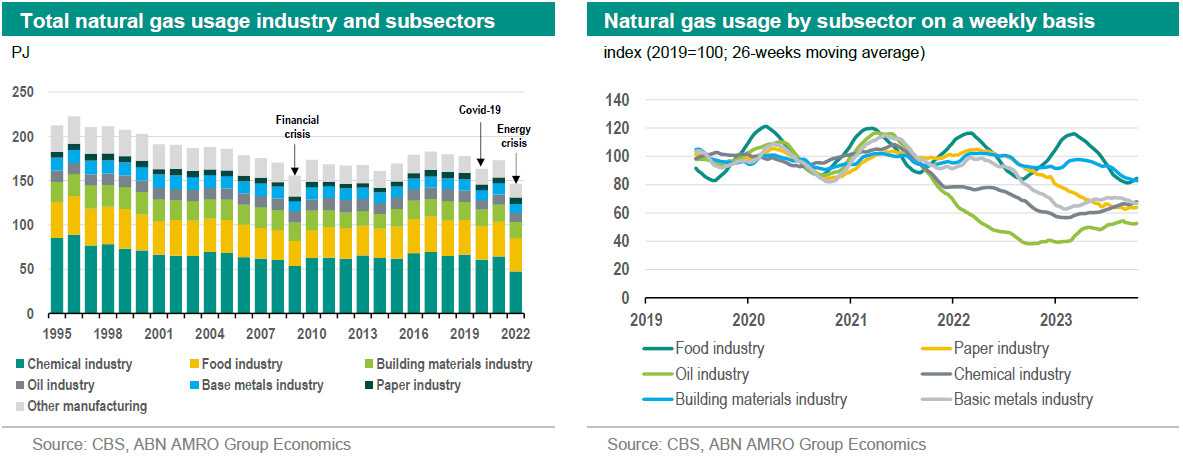

Gas usage Industry

Rationalisation of energy consumption is not new in industry. Since the oil crisis in the 1970s, designing the production process to be as efficient as possible became part of the DNA of many industrial companies. From then on, all kinds of measures were taken to improve processes. After the crisis of the 1970s, things are actually not much different. The financial crisis of 2008-2009, the Covid-19 crisis and the recent energy crisis also put the business continuity of many industrial companies on high alert and triggered them to reduced energy consumption.

More than three quarters of total Dutch natural gas consumption is accounted for by economic activities in sectors. Most of this is consumed by industry, with a 40% share of total gas consumption. In Dutch industry, six subsectors are then dominant when it comes to volumes of gas consumption. These are - in order of most gas consumption - the chemical industry, the food industry, the building materials industry, the petroleum industry, the basic metal industry and the paper industry. Together, these six sectors account for 85-90% of total industrial gas consumption. The chemical industry accounts one third of gas consumption, followed by the food industry with a share of25% and then the building materials industry (13%).

In 2022, gas consumption was significantly lower in almost all sectors due to higher gas prices. Only in the paper industry did gas consumption increase in 2022 (by 7%). In the other five largest gas consumers in the industry, gas consumption decreased by an average of 14% in 2022. In 2023, at a time when gas prices are normalising somewhat, gas consumption in three sectors is increasing again. For instance, gas consumption in mid-October in the petroleum industry is 101% higher compared to the first week of 2023. And in the chemical industry and the basic metal industry, the increase is 29% and 11% respectively. In other sectors, gas consumption has continued to fall in 2023.

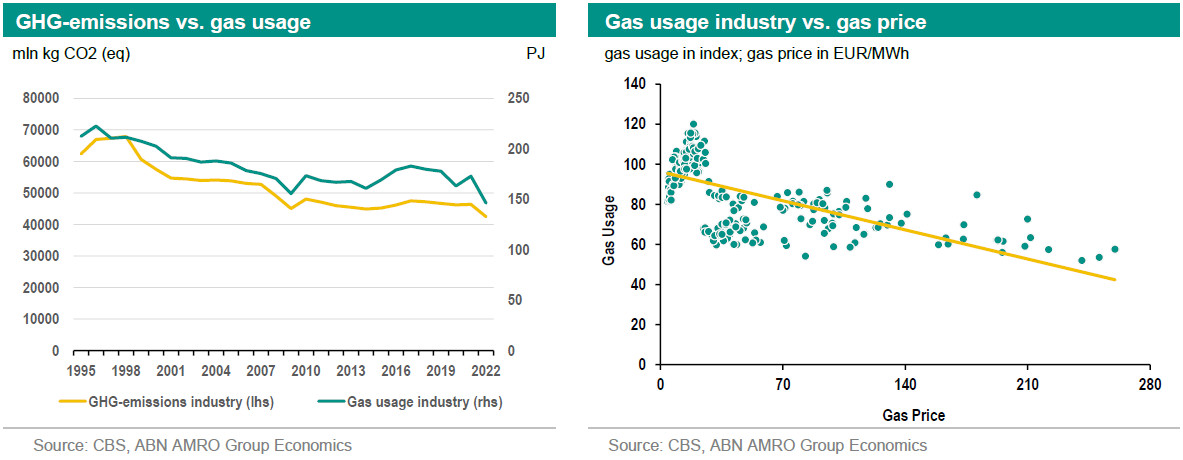

Lower gas consumption in industrial sectors has helped reduce greenhouse gases. In 2022, greenhouse gas emissions in total industry decreased by 11%, while industrial gas consumption fell by around 25%. With the reduction of gas in the production process, the use of other fuels often increased to maintain production levels. The fact that the non-fossil option could often not be chosen directly when reducing gas consumption contributed to the fact that the rate of emission reduction is slower than the rate of reduction in gas consumption. Other and additional measures are needed to accelerate GHG reductions.

Relatively high gas prices have been a strong incentive for many industrial companies to rapidly reduce gas consumption and improve the energy efficiency. We can see this in the chart on the right above. Indeed, less gas consumption translates directly into lower production costs. But rationalisation in gas consumption was also a necessary choice from the perspective of competitiveness. Indeed, higher gas prices also put industrial companies at a disadvantage internationally. For the Netherlands even more so than in other countries within the eurozone.

Energy crisis puts Dutch industry at a disadvantage

Over the years, countries have seen large fluctuations in energy prices, other input costs and also exchange rates. These fluctuations could differ greatly from one country to another. For instance, the ultimate impact of the 1970s oil crisis was much greater for countries that were heavily dependent on oil imports. For some countries, moreover, the crisis had a longer-lasting impact, while others experienced it for a relatively short period of time.

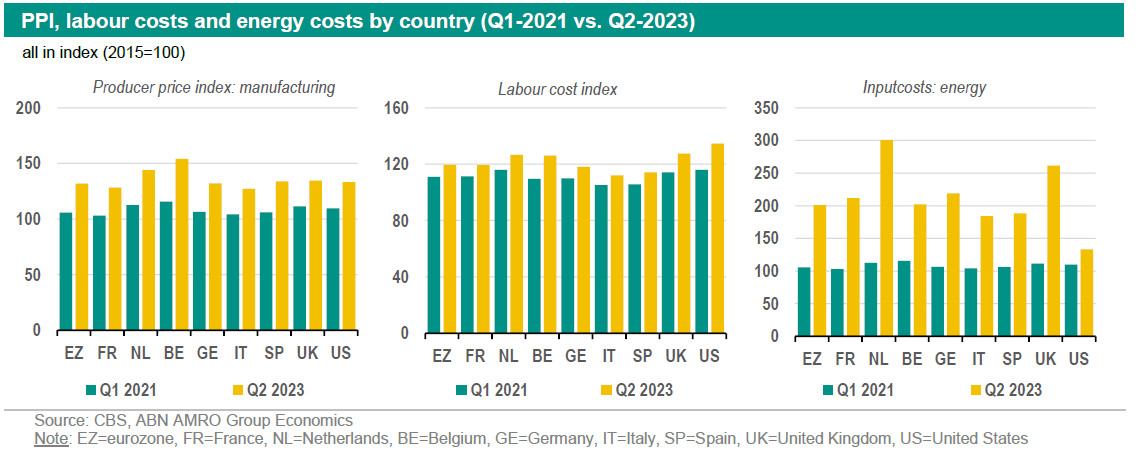

Although the recent energy crisis hit all countries, we still see large differences between countries. In the three figures above, we compare the producer price index, labour costs and energy costs in the first quarter of 2023 (most recent) with the position in the first quarter of 2021 (at the start of the energy crisis). The Netherlands tends to be worse off in terms of the three indicators compared to the other countries in the figure. But what is particularly striking is that in terms of energy costs, the Netherlands is the worst off in 2023, while in early 2021 the playing field in this area was almost identical for many countries. The import price of gas plays an important role in this.

Netherlands dependent on gas

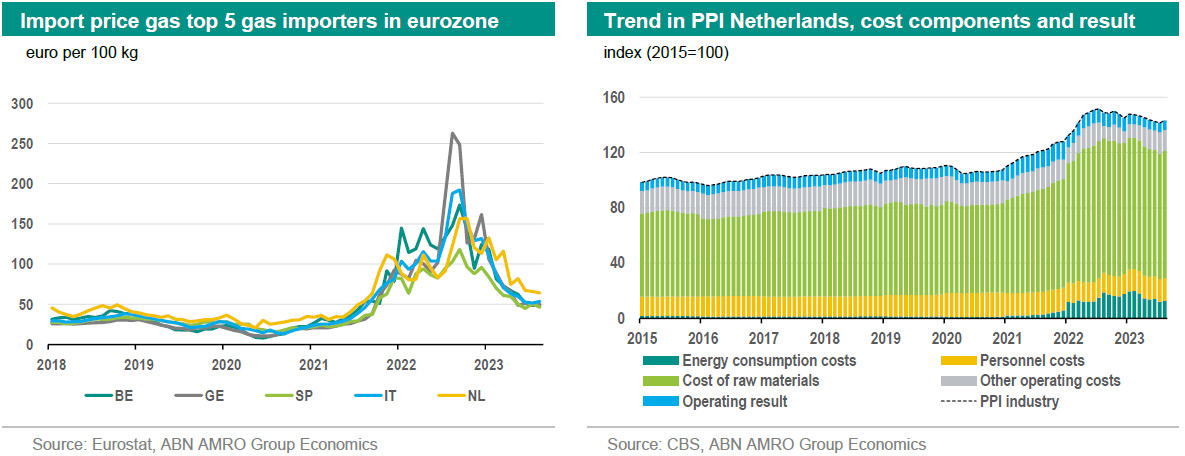

Currently, the Netherlands is about 70% dependent on gas imports. This makes the Netherlands more sensitive to fluctuations in the gas price. Moreover, the prices of natural gas differ widely worldwide. There is a difference between futures prices and spot prices, and prices on exchanges, such as the Title Transfer Facility (TTF) and the Power Exchange Central Europe (PXE), also differ widely. For this analysis, we calculated the import price of gas by country by using Eurostat data. In this way, we increase comparability between countries. The calculation of the import price in the left figure is based on import value (in euro) of gas and the quantity imported (in 100 kg).

What stands out from this calculation is that the Netherlands pays more for its imported gas. The average import price of gas for the Netherlands over the first eight months of 2023 is on average 35% higher than the average import price of the other four largest gas importers in the eurozone. Compared to the eurozone average, the import price of gas is about 11% higher in the Netherlands. Such large differences come at the expense of price competition in global markets.

Ultimately, these higher gas prices also affect industrial business results. The figure on the right above shows that the cost of energy and also the purchase of raw and auxiliary materials have been important determinants of the trend in the producer price index over the past two years. The sharp rise in the overall industrial producer price index in the Netherlands has been fuelled mainly by sharp price increases in raw material and energy-intensive industries, such as petroleum, chemicals, wood and building materials and basic metals. As energy, as well as other raw and auxiliary materials are important inputs for many industry subsectors, higher energy and raw material prices have undermined Dutch competitiveness. What is more, the uncertainties and risks in the global gas market will continue for some time. So, to become less vulnerable to the volatility of the gas market and further reduce import dependency, it remains important to further rationalise industrial gas consumption. This can be done, for example, by further improving the energy efficiency of industrial processes. In the end, chances increase that competitiveness of Dutch industry will recover and that greenhouse gas emissions will be reduced further.

This article is part of the SustainaWeekly of 6 November 2023