Dutch elections - Convergence in polls suggest a tight race

The Dutch head to the ballot box coming Wednesday, polls suggest that support for the four largest parties has converged. A centrist 4-party coalition now could have a majority, but is being ruled out for now by the centre-right VVD party-leader Yeşilgöz. Such a coalition has overlap but also large differences, suggesting a challenging formation process lies ahead. The election programme of each of the parties points to higher deficits in the coming years... but for next year, we expect the impact on the funding need to be limited because the policy changes will take time to have an effect. Unlike two years ago, the pension transition is not on the political agenda during these elections.

Jaap Teerhuis

Senior Fixed Income Strategist

Largest parties inch closer to each other; PVV within reach for GL/PvdA, CDA and D66

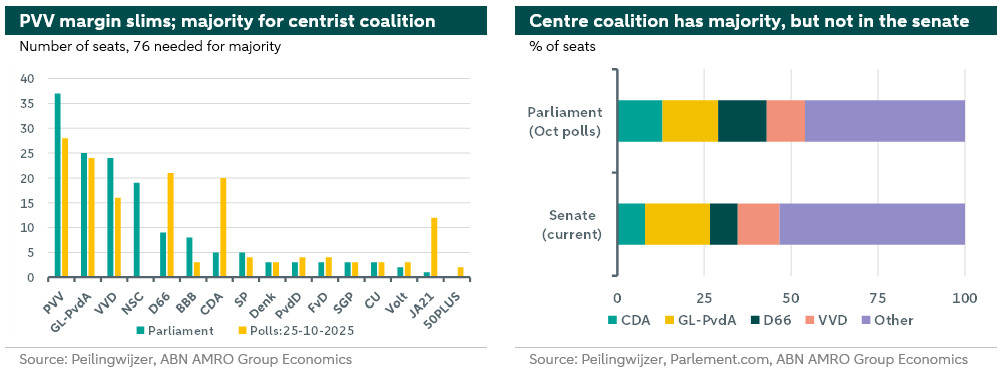

The Dutch public head to the ballot box this Wednesday. Dutch election campaigns are typically backloaded with large shifts in polls in the last weeks leading up to the election. This election round is no different. Compared to roughly 2 weeks ago we have seen a trend of the big parties inching closer to each other. The PVV (far-right), still polled as election winner at 28 seats, but sees it’s margin to other parties is diminishing. This means that the battle for the biggest party is still wide open. GL/PvdA (centre-left) is now polling at 24 seats as the second biggest party, however Mr. Timmermans’ party has been stagnating in the polls. More changes are visible at the CDA (Christian democratic, centre-right) and D66 (centre-liberal). The traditional centre party, the CDA (polling at 20 seats), which is being led by relative newcomer Mr. Bontenbal, still polled as the biggest gainer coming from just 5 seats in the last election, saw its support declining last week. D66, led by Rob Jetten, on the other hand has gained more than 5 seats in the polls and is at 21 seats since the televised debates began. Furthermore, on the right we see the VVD (centre-right, polling at 16 seats) recovering somewhat recently in the polls and JA21 (right-wing), who gained a considerable share of seats at 12 seats in the polls, coming from just 1, not profiting further from their position as an alternative for instance for the PVV. Still, much can change in the coming days, especially since a large share of voters is still undecided, and the polls did not accurately predict the PVV's victory in the previous elections.

Polls give centrist coalition a majority, but is ruled out by VVD party-leader Yeşilgöz … for now

With 16 parties expected to achieve at least 1 seat, political fragmentation remains high in Dutch politics. The biggest party, the PVV is excluded by most parties as a coalition partner. As a result, only one coalition looks feasible. It would be made up of the four broad centre parties, namely the CDA, GL/PvdA, D66 and the VVD. However, up until now, VVD party-leader Yeşilgöz has ruled out joining a coalition with GL/PvdA. Given this, chances for such a coalition would increase under a different Prime Minister than GL/PvdA’s Timmermans. The eventual Prime Minster also matters for the Dutch position in Europe. Frans Timmersmans, due to his history as Vice-President of the European Commission is more known across Europe than relative newcomers such as Rob Jetten (D66), Henri Bontenbal (CDA) and Dilan Yeşilgöz (VVD). Other less feasible coalitions given recent polling are over to the “right”, with the addition of JA21 instead of GL/PvdA, currently polling at 69 seats where 76 are needed. Or over to the “left”, with the addition of more than 1 of the smaller left-wing parties. Finally, a minority government could be a non-conventional option, though this has been rarely mentioned recently. It all depends on the final election results, with exit polls expected at Wednesday at around 9pm. Based on the above, the formation process is expected to be challenging once more, despite the fact that parties expressed their readiness to form a new coalition before Christmas.

Centrist parties have overlap, but significant differences suggest a challenging formation

While a lot can still change and generally it is too early to look at potential coalitions, it is interesting to see where there is agreement among CDA, GL/PvdA, D66 and the VVD. On which main issues do we see overlap in terms of policy ambition? The stance towards Europe will likely turn more constructive compared to the previous Schoof 1 cabinet. Election manifestos show that there is an ambition to further integrate the capital markets union and focus on removing internal trade barriers in the European Single Market. On common financing (Eurobonds), there seems to be less agreement, though there is room for negotiation, with parties such as D66 and GL/PvdA moderately in favour, while the CDA, who traditionally opposed common financing, have signalled a more constructive stance. Equally, these four parties are in favour of increasing defence spending until 2030 and thereby ramping up defence spending to reach the NATO-target of 3.5%. Finally, there seems to be to reduce nitrogen emissions, though parties have different approaches on how to do so.

In other areas the parties have different ideologies and make different choices, suggesting a tough negotiation process lies ahead. First and foremost, on tax and income policies. The VVD and GL/PvdA make different choices on where to increase and decrease taxation. One stark difference is on higher taxation for companies and wealth as GL/PvdA suggest, and which the VVD opposes, the prime reason why VVD party-leader Yeşilgöz is up until now ruling out forming a coalition with GL/PvdA. Also in terms of reigning in healthcare spending and social security there are differences between the more right leaning centre parties and the more left leaning parties. On for instance climate policy we also see differences. We have assessed that on climate policy the likelihood of intensification will be highest if D66, GL/PvdA and CDA are part of the new coalition, with VVD taking a more conservative stance. On the housing market, the four parties provide different solutions to increase housing supply with the VVD being against a further reduction in the mortgage interest tax deduction (HRA), a policy stance that it considers to be a red line in any coalition negotiations.

Calculations by the show that on the budget there seems to be a consensus among these parties for significant deficits and continued support for the economy, even if this appears to be at odds with an economy running at capacity and elevated inflation. Forecasts show all four parties having budget deficits between 2 and 3% of GDP.

Elections are expected to have limited impact on the funding need next year

As we described above and in our previous publication on the elections (see here), the plans outlined in the election manifestos will lead to higher budget deficits in the coming years. However, we do not expect the elections to have a major impact on the funding needs for 2026. The reason for this is that the elections will be held close to the end of this year and, based on current polls, it is expected that negotiations for a new coalition will once again take a long time. As a result, this new coalition will probably not be installed until early next year, and it will then take some time before the polices of the new coalition take effect. This means that the effect of this new policy will not have an impact on funding needs until the end of next year at the earliest. As a result, next year's budget, which was presented by the outgoing cabinet on Prinsjesdag in September, will mainly apply next year. This budget has been stripped of politically arbitrary elements, as is customary for an outgoing cabinet.

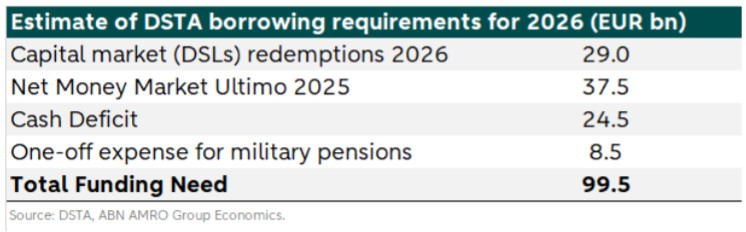

For next year, we expect the funding need to amount to approximately EUR 100 billion, which is about EUR 20 billion higher than our estimated final funding need for this year. There are two reasons why the funding need will be higher in 2026. Firstly, two DSLs will expire next year, whereas only one DSL expired in 2025. The difference, EUR 9 billion, increases the funding need for next year. Secondly, the budget deficit will be higher next year at 2.7% compared to 1.9% this year. The expected deficit also includes a one-off EUR 8.5 billion payment for military pensions to the civil service pension fund ABP. ABP will transition to the new pension system effective 1 January 2027 and since no contributions were paid for pensions accrued before June 2001, a reserve has been budgeted for 2026 to compensate for this under the new system.

Pension transition not on the political agenda in these elections

The pension transition is now underway, with some smaller pension funds having already made the transition to the new defined contribution framework. In January, a larger group of pension funds, including some large funds, are expected to transition to the new system. The new pension law, which came into effect in mid-2023, is not expected to undergo any major changes due to the upcoming elections at this point. After a radical proposal to amend the pension law, which would almost certainly have led to a long-term postponement of the transition, was narrowly voted down by parliament in May this year, this topic has disappeared from the political agenda. Nor is there any mention of (partially) reversing the new Act in the election manifestos of most political parties. Moreover, the parties that do want this or that were in favour of the legislative changes in May this year are polling considerably lower. As a result, we expect that there will no longer be any political obstacles to the pension transition.