China - Mixed signals from the December PMIs

China Macro: December manufacturing PMIs disappoint, while the December services PMIs came in clearly stronger than expected.

China Macro: December manufacturing PMIs disappoint …,

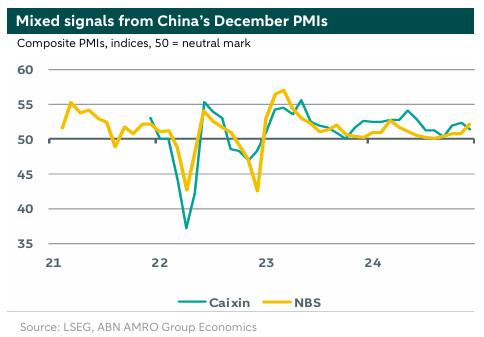

China’s December PMIs published over the last week provided mixed signals over the state of the Chinese economy, with the manufacturing PMIs disappointing and the services PMIs coming in clearly stronger than expected. To start with the industrial side, the two manufacturing PMI’s published by NBS and Caixin last week remained in expansion territory, but came in weaker compared to the November readings and also compared to consensus expectations. Caixin’s manufacturing PMI fell back by a full point to 50.5 in December after a surprise jump to 51.5 in November (consensus: 51.7). The ‘official’ manufacturing PMI (NBS) was less volatile: this index dropped marginally to 50.1 in December (November: 50.3, consensus: 50.2). Looking at the manufacturing PMI sub-indices, the most eye-catching moves were the sharp declines in Caixin’s components for output (decline by 2.7 points to 50.5) and export orders (down by almost 3 points to 48.6, back in contraction territory). Caixin’s domestic orders component also dropped back to 51.6 (November: 52.9), but remained in expansion territory. A common feature of both manufacturing surveys was the sharp drop in the input price component, indicating ongoing deflationary pressures. Meanwhile, the employment subindex remained below the neutral mark in both surveys, although Caixin’s sub-index rose to a four-month high of 49.3.

… while the December services PMIs came in clearly stronger than expected

By contrast, the December services PMIs came in clearly stronger than expected. Whereas for November the services PMIs had been weaker than (or equal to) their manufacturing counterparts for the first time since 2022, this picture turned around in December. Today, Caixin’s services PMI came in at a seven-month high of 52.2 (November: 51.5, consensus: 51.4). And the non-manufacturing PMI published by NBS on 31 December rose by more than two points to a nine-month high of (also) 52.2 (November: 50.0, consensus: 50.2). Particularly striking in this context was the sharp rise in the construction component of the non-manufacturing PMI, by a whopping 3.5 points to a 7-month high of 53.2 (November: 49.7). This likely reflects in part the stepping up of targeted stimulus for the property sector, and Beijing’s explicit remarks on the need to stabilise this sector. All in all, the official composite PMI (a weighted average of the output components in the manufacturing and non-manufacturing surveys) rose to a 9-month high of 52.2 in December (November: 50.8). By contrast, Caixin’s composite PMI dropped back to a three-month low of 51.4 (November: 52.3).

To conclude, the latest PMIs are in line with our expectation that quarterly GDP growth will pick up in Q4-2024. That improvement reflects Beijing’s pivot to step up stimulus since September, payback from weakness in the previous quarter(s) and potentially also some trade frontloading that will positively impact net exports in Q4-24 and Q1-25. The improvement in momentum puts the Chinese economy on a more stable footing now we have moved into 2025, a year it will likely face higher US import tariffs (which we expect to be implemented from Q2-25 onwards). We also expect more monetary easing and a stepwise approach to more fiscal stimulus, partly to offset the headwinds from higher tariffs (also see our China 2025 outlook That 2018 (tariff) feeling – What’s different in 2025? and our comment on the November activity data and China’s annual Central Economic Work Conference held last month here).