Key views Global Outlook 2025

The return of president Trump to the White House is likely to mean a significant rise in US import tariffs in 2025. China will bear the brunt, but Europe will also be hit. Global trade and growth will initially benefit from a frontloading ahead of the tariff rises, before slowing sharply later in 2025. Against this backdrop, domestic demand is recovering in the eurozone and China, helped by falling interest rates and targeted fiscal measures in China, while in the US, deregulation and tax cuts will help blunt the real income shock from tariff rises. Inflation in the US is expected to reaccelerate, but to fall below target in the eurozone. All of this is likely to drive a divergence in Fed & ECB policy, with slower and fewer Fed rate cuts, and the ECB deposit rate ultimately falling to 1%. This is expected to push the euro towards parity against the dollar in the course of 2025.

Macro

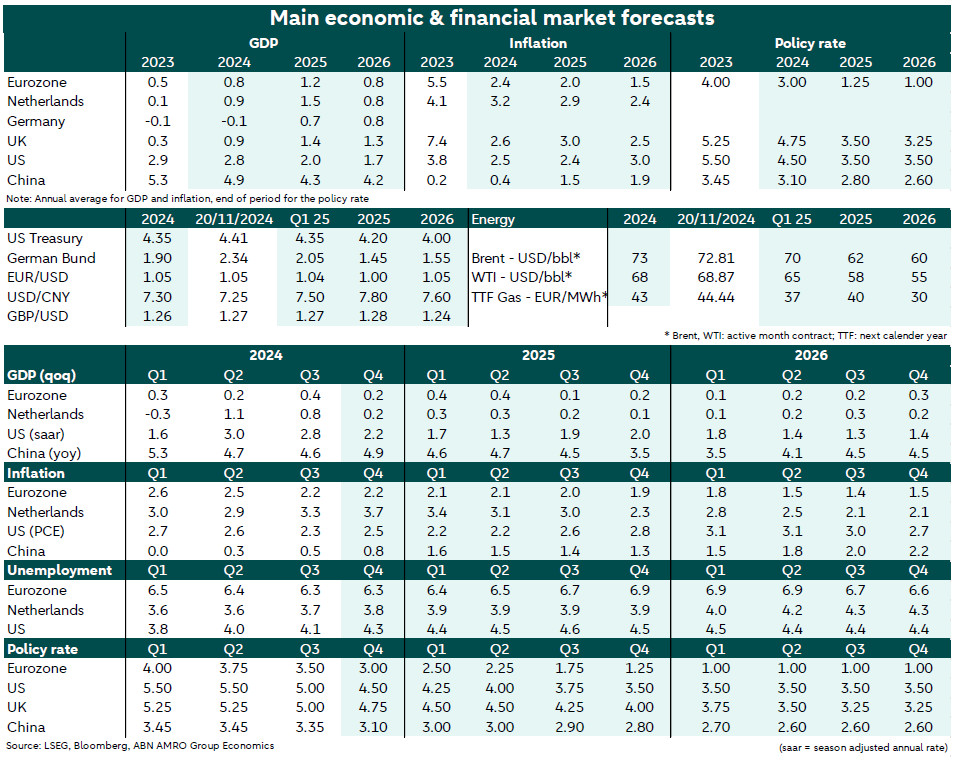

Eurozone – The eurozone recovery is set to continue in early 2025, helped by rate cuts feeding through and real income gains supporting private consumption. Our tariff scenario has significant repercussions for the eurozone outlook. Initially in the first half of 2025 frontloading effects actually boost quarterly growth. Afterwards, we see growth and inflation negatively impacted by the gradual implementation of US import tariffs from 25Q3 onwards. In 2026 inflation will undershoot the target. Growth is expected to average 0.8% in 2024 and rise to 1.2% in 2025 to slow down to 0.8% in 2026.

The Netherlands – In 2024, the economy has performed robustly. Q1 was still meagre, but Q2 and Q3 showed solid growth with GDP expanding by 1.1% and 0.8% respectively. Risks on the external side are tilted to the downside particularly because of the implementation of US import tariffs. Growth will be domestically driven and will average 0.9% this year, 1.5% next year, and 0.8% in 2026. Unemployment will increase slightly, but the tight labour market remains a constraining factor. Inflation is expected to stay above the 2% target in the coming years, driven by still high wage growth.

UK – In November, the government announced a fiscal expansion amounting to c1% of GDP. This, alongside rising real incomes, is likely to keep the economy on a solid recovery path for now, though structural challenges remain. New US trade tariffs pose downside risks to growth in H2 25, but the UK is less vulnerable than the eurozone as it is less export dependent. Services inflation is stubbornly high, with wage growth still well above levels consistent with 2% inflation. A sustained return to 2% inflation will take longer than elsewhere, due to historically higher inflation expectations in the UK.

US – Growth and consumption remain strong, while the labor market cools. Growth in labour demand is slowing, and is outpaced by increases in labor supply, but demand has not yet contracted. Upcoming stimulative policy notwithstanding, a weakening labour market and pockets of financial stress among households are likely to contribute to a slowdown in growth into 2025. Tariffs will start to impact growth and inflation in the course of next year. We have raised our 2025 growth forecast to 2.0% on the back of still strong momentum, while the tariff impact raises our 2025 inflation forecast to 2.4%.

China – Just as growth momentum is picking up as 2024 ends, an expected rise in US tariffs under Trump 2.0 will create more drags in 2025. We assume a bigger tariff shock compared to 2018-19, with a build-up to an average rate of 45%. Still, China is now less dependent on the US, has developed a playbook to react, and will use CNY depreciation and stimulus to offset tariff risks. We cut our 2025 annual growth forecast to 4.3% (from 4.5%) and expect annual growth to drop to 4.2% in 2026. But risks surrounding these forecasts have risen following the US elections, and are tilted to the downside.

Central Banks & Markets

ECB – We expect the ECB to continue cutting rates in December as well as throughout 25Q1. We see the ECB pausing at in April as uncertainty over tariffs as well as policy rates approaching the ECB’s assessment of neutral are reason to adopt a wait-and-see approach. As the impact of tariffs on growth and inflation feed through we see the ECB resume their easing cycle at the June meeting and cut rates by more than markets currently price until the deposit rate reaches 1% in early 2026. This means, a year from now the ECB will have moved from restrictive to an accommodative policy stance

Fed – After another rate cut, the Fed’s upper bound on fed funds rate stands at 4.75%. We expect one more 25bps cut this year. The Fed will remain attentive to upside risks to inflation and downside risks to, in particular, the labour market. Greater fiscal policy uncertainty and a new impulse to inflation slow down the Fed in 2025 to 25 bps per quarter. The upper bound of the policy rate reaches 3.50% at the end of the year, where it will stay for an extended time until tariff-induced inflation wanes.

Bank of England – The MPC lowered Bank Rate to 4.75% in November, in line with our expectations. Incoming data suggests stubbornly high underlying inflationary pressure, and sticky wage growth. At the November Budget, the government announced a combination of tax rises to fund regular spending, and additional debt to fund growth enhancing public investment. This poses upside risks to medium-term inflation, and is likely to keep rate cuts at a more gradual pace than for the ECB. We expect three 25bp rate cuts each in 2025 and 2026, taking Bank Rate to 3.25% by end-2026.

Bond yields – We expect monetary policy and rates divergence between the US and eurozone in 2025. On the one hand, we see US Treasury yields staying elevated due to an earlier end to rate cuts. Additionally, we expect a higher term premium in the US due to the growing fiscal deficit and debt outlook for the upcoming years. On the other hand, we expect Tump's policy to prompt the ECB to lower the deposit rate to as low as 1% by early 2026. Consequently, European bond yields are expected to decline significantly as we approach H2 2025, given the gap between our view and market pricing.

FX – We recently downgraded our EUR/USD forecasts to 1.05 (was 1.10) for end 2024, and to 1.0 for end 2025 (was 1.15). We have for end 2026 1.05. These new forecasts reflect the outcome of the US elections, the possible impact of US tariffs, more ECB easing to come and widening rate spreads in favour of the US. Indeed, we expect more rate cuts for the Fed and the ECB in 2025-26 than markets currently price, though the gap with market pricing is larger for the ECB, especially towards the end of 2025.